America is back e a nova era da energia barata nos EUA

O estado Americano com a taxa de desemprego mais baixa é North Dakota (3,3%), onde explodiu a produção de petróleo.

Um bom artigo onde é descrito o ambiente que se vive neste estado:

http://www.bloomberg.com/news/2012-01-2 ... -soar.html

Resumindo, o estado não tem condições para o aumento de população que está a ter

Um bom artigo onde é descrito o ambiente que se vive neste estado:

http://www.bloomberg.com/news/2012-01-2 ... -soar.html

Resumindo, o estado não tem condições para o aumento de população que está a ter

- Mensagens: 87

- Registado: 9/8/2011 19:58

Finalmente, já consegui clarificar a questão do "shale oil" e "oil shale".

O petroleo resultante da perfuração horizontal/fractura hidráulica do "shale" (tradução correcta para Português é xisto argiloso ou Folhelho), é chamado de "tight oil", o qual é um petróleo leve.

"Tight oil (also known as light tight oil, abbreviated LTO) is a Petroleum play that consists of light crude oil contained in petroleum-bearing formations of relatively low porosity and permeability (shales).[1] It uses the same horizontal well and hydraulic fracturing technology used in recent boom in production of shale gas. It should not to be confused with oil shale and shale oil as it differs by the API gravity and viscosity of the fluids, as well as the method of extraction.

Tight oil formations include the Bakken Shale, the Niobrara Formation, Barnett Shale, and the Eagle Ford Shale in the United States, R'Mah Formation in Syria, Sargelu Formation in the northern Persian Gulf region, Athel Formation in Oman, Bazhenov Formation and Achimov Formation in West Siberia, and Chicontepec Formation in Mexico.[1]"

wikipedia http://en.wikipedia.org/wiki/Tight_oil# ... te-mills-0

Explicação completa aqui:

http://www.spec2000.net/18-tightoil.htm

O petroleo resultante da perfuração horizontal/fractura hidráulica do "shale" (tradução correcta para Português é xisto argiloso ou Folhelho), é chamado de "tight oil", o qual é um petróleo leve.

"Tight oil (also known as light tight oil, abbreviated LTO) is a Petroleum play that consists of light crude oil contained in petroleum-bearing formations of relatively low porosity and permeability (shales).[1] It uses the same horizontal well and hydraulic fracturing technology used in recent boom in production of shale gas. It should not to be confused with oil shale and shale oil as it differs by the API gravity and viscosity of the fluids, as well as the method of extraction.

Tight oil formations include the Bakken Shale, the Niobrara Formation, Barnett Shale, and the Eagle Ford Shale in the United States, R'Mah Formation in Syria, Sargelu Formation in the northern Persian Gulf region, Athel Formation in Oman, Bazhenov Formation and Achimov Formation in West Siberia, and Chicontepec Formation in Mexico.[1]"

wikipedia http://en.wikipedia.org/wiki/Tight_oil# ... te-mills-0

Explicação completa aqui:

http://www.spec2000.net/18-tightoil.htm

- Mensagens: 87

- Registado: 9/8/2011 19:58

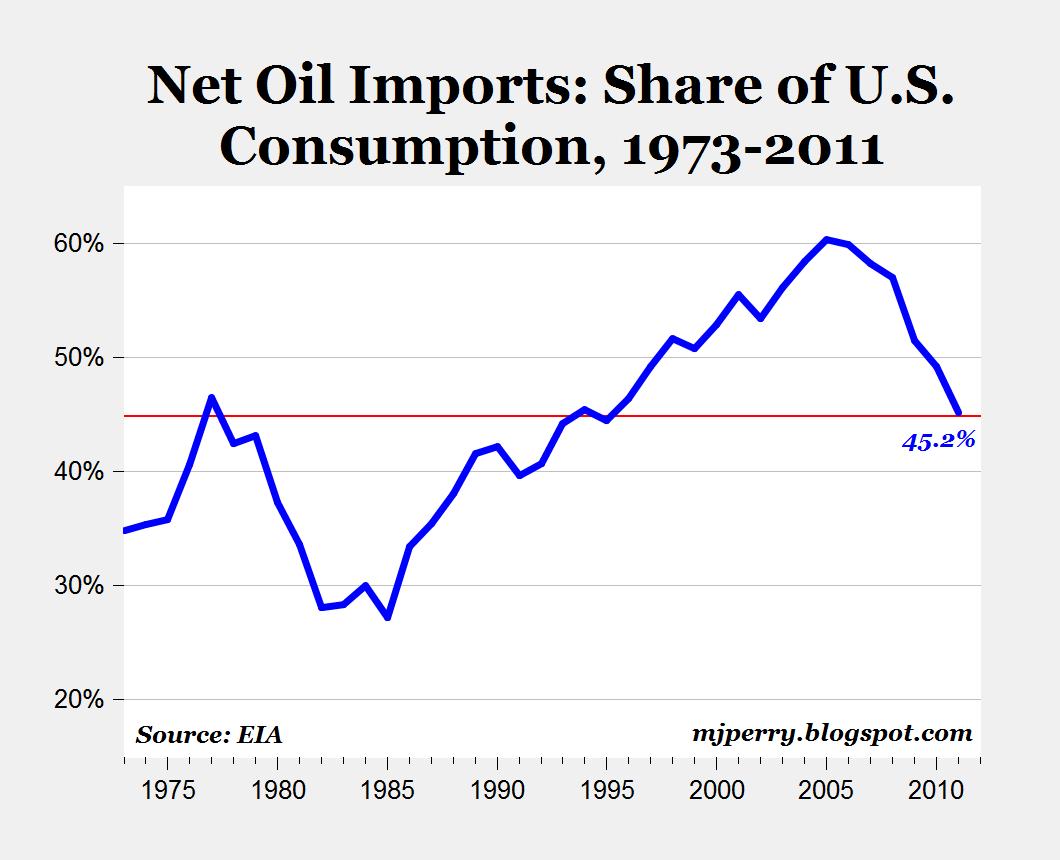

Gráfico com importação de petroleo USA

here we go baby ...

- Mensagens: 87

- Registado: 9/8/2011 19:58

Energia eléctrica cai 50% - Bloomberg

17/01/2012

Electricity Declines 50% as Shale Spurs Natural Gas Glut: Energy

http://www.bloomberg.com/news/2012-01-1 ... nergy.html

A shale-driven glut of natural gas has cut electricity prices for the U.S. power industry by 50 percent and reduced investment in costlier sources of energy.

With abundant new supplies of gas making it the cheapest option for new power generation, the largest U.S. wind-energy producer, NextEra Energy Inc. (NEE), has shelved plans for new U.S. wind projects next year and Exelon Corp. (EXC) called off plans to expand two nuclear plants. Michigan utility CMS Energy Corp. (CMS) canceled a $2 billion coal plant after deciding it wasn’t financially viable in a time of “low natural-gas prices linked to expanded shale-gas supplies,” according to a company statement.

Mirroring the gas market, wholesale electricity prices have dropped more than 50 percent on average since 2008, and about 10 percent during the fourth quarter of 2011, according to a Jan. 11 research report by Aneesh Prabhu, a New York-based credit analyst withStandard & Poor’s Financial Services LLC. Prices in the west hub of PJM Interconnection LLC, the largest wholesale market in the U.S., declined to about $39 per megawatt hour by December 2011 from $87 in the first quarter of 2008.

Power producers’ profits are deflated by cheap gas because electricity pricing historically has been linked to the gas market. As profit margins shrink from falling prices, more generators are expected to postpone or abandon coal, nuclear and wind projects, decisions that may slow the shift to cleaner forms of energy and shape the industry for decades to come, Mark Pruitt, a Chicago-based independent industry consultant, said in a telephone interview.

Power Earnings Impact

Natural gas fell today on investor concerns that mild winter weather in the U.S. will damp demand. Natural gas for February delivery fell 18.2 cents, or 6.8 percent, to $2.488 per million British thermal units on theNew York Mercantile Exchange, the lowest settlement price since March 2002.

“You’re lowering the earnings ceiling every time natural- gas prices drop,” said Pruitt, former director of the Illinois Power Agency, which negotiates power-purchase agreements for the state’s utilities.

Price declines are expected to hurt fourth-quarter 2011 earnings and continue to depress profits through 2012, Angie Storozynski, a New York City-based utilities analyst with Macquarie Capital USA Inc., said in a Jan. 11 research note.

Hardest hit will be independent power producers in unregulated states such as Texas and Illinois, which don’t have the protections given regulated utilities where states allow a certain level of profits.

60 Percent Decline

The Standard & Poor’s independent power producer index, which groups Constellation Energy Group Inc. (CEG), NRG Energy Inc. (NRG) and AES Corp. (AES), has fallen 60 percent since the beginning of 2008, compared with a 14 percent drop for the Standard & Poor’s 500 Index, according to data compiled by Bloomberg.

Low gas prices drained the momentum from a resurging nuclear industry long before last year’s meltdowns at the Fukushima Dai-Ichi plants in Japan, said Paul Patterson, a New York City-based utility analyst with Glenrock Associates LLC. No applications to build new reactors have been filed with federal regulators since June 2009.

Exelon, the largest U.S. nuclear operator, canceled plans last summer to boost capacity at two nuclear plants in Illinois and Pennsylvania after analyzing economic factors, Marshall Murphy, a spokesman for Chicago-based Exelon, said in an e-mail.

CMS Energy’s canceled coal plant, planned for Bay City, Michigan, would have showcased the newest pollution-control technology for capturing and storing carbon-dioxide emissions.

Wind Expansion Slows

Investors also are cooling on wind investment because of falling power prices, a lack of transmission infrastructure and the possibility that federal subsidies may expire next year. T. Boone Pickens, one of wind power’s biggest boosters, decided to focus on promoting gas-fueled trucking fleets after canceling plans for a Texas wind farm in 2010.

“Boone still sees wind being a key part of America’s energy future,” Jay Rosser, a spokesman for Pickens, said in an e-mail. “Natural-gas prices will ultimately rise and make wind energy more competitive in the process.”

NextEra didn’t include new U.S. wind projects in its financial forecast for 2013, Lew Hay, chief executive officer of the Juno Beach, Florida-based company, said in a November conference call with investors. NextEra’s wind expansion after 2012, when a federal tax credit for wind generators is expected to expire, is contingent upon “public policy support,” said Steve Stengel, a spokesman for NextEra, in a telephone interview.

“Wind on its own without incentives is far from economic unless gas is north of $6.50,” said Travis Miller, a Chicago- based utility analyst at Morningstar Inc. (MORN)

Shale Gas Boom

U.S. gas supplies have been growing since producers learned how to use hydraulic fracturing and horizontal drilling to tap deposits locked in dense shale rock formations. Gas prices have been falling since mid-2008, when a global recession sapped demand just as drilling accelerated in the gas-rich Marcellus shale in the eastern U.S., according to data compiled by Bloomberg.

Gas prices collapsed further in late 2011 on concerns mild winter weather in the U.S. will curb demand for the heating fuel. Gas is expected to stay below 2011’s average price of $4.026 for the next two years, priced at around $3.10 per million British thermal units for 2012 and $4 for 2013, according to Robert W. Baird (BADC) & Co., an investment bank based in Milwaukee.

New Gas Generation

Declining power prices may also make it unprofitable for utilities to install pollution controls on older coal-fired plants, adding to the wave of plant closures that are expected to result from new U.S. Environmental Protection Agency rules over the next two to three years, Pruitt said.

As much as 90 gigawatts of new generation, enough capacity to light 72 million homes and businesses, will be needed by 2015 to replace retiring coal plants and meet electricity demand, according to a Nov. 30 research report by Hugh Wynne, an analyst at investment bank Sanford C. Bernstein.

Cheap gas makes it difficult for rival forms of fuel to compete, said Sam Brothwell, a senior utility analyst with Bloomberg Industries, in a telephone interview. Historically, gas-fired generators have been the least expensive to build, offset by a higher fuel cost, Brothwell said. With gas falling below $3, “it makes all other forms of producing electricity look less competitive by comparison,” he said.

Gas Power Costs

The cost, including construction, to produce one megawatt hour of gas-fueled electricity was $62.37 an hour in the third quarter of 2011, which was less expensive than coal, wind and solar generators, according to data compiled by Bloomberg.

Power companies are leery of becoming too dependent on gas, which historically has had the biggest price swings of all the power fuels. In 2005, gas prices climbed to nearly $14 after hurricanes disrupted production in the Gulf of Mexico.

Project cancellations, along with a broader switch from coal to gas, will leave the industry with fewer alternatives and thus more exposed to rising gas prices, Pruitt said.

“The way to make $4 gas $8 gas is for everyone to go out and build combined-cycle natural-gas plants,” Michael Morris, non-executive chairman of American Electric Power (AEP) Inc., said at an industry conference in November. “We need to be cautious about how we go about this.”

To contact the reporters on this story: Julie Johnsson in Chicago at jjohnsson@bloomberg.net; Mark Chediak in San Francisco at mchediak@bloomberg.net

17/01/2012

Electricity Declines 50% as Shale Spurs Natural Gas Glut: Energy

http://www.bloomberg.com/news/2012-01-1 ... nergy.html

A shale-driven glut of natural gas has cut electricity prices for the U.S. power industry by 50 percent and reduced investment in costlier sources of energy.

With abundant new supplies of gas making it the cheapest option for new power generation, the largest U.S. wind-energy producer, NextEra Energy Inc. (NEE), has shelved plans for new U.S. wind projects next year and Exelon Corp. (EXC) called off plans to expand two nuclear plants. Michigan utility CMS Energy Corp. (CMS) canceled a $2 billion coal plant after deciding it wasn’t financially viable in a time of “low natural-gas prices linked to expanded shale-gas supplies,” according to a company statement.

Mirroring the gas market, wholesale electricity prices have dropped more than 50 percent on average since 2008, and about 10 percent during the fourth quarter of 2011, according to a Jan. 11 research report by Aneesh Prabhu, a New York-based credit analyst withStandard & Poor’s Financial Services LLC. Prices in the west hub of PJM Interconnection LLC, the largest wholesale market in the U.S., declined to about $39 per megawatt hour by December 2011 from $87 in the first quarter of 2008.

Power producers’ profits are deflated by cheap gas because electricity pricing historically has been linked to the gas market. As profit margins shrink from falling prices, more generators are expected to postpone or abandon coal, nuclear and wind projects, decisions that may slow the shift to cleaner forms of energy and shape the industry for decades to come, Mark Pruitt, a Chicago-based independent industry consultant, said in a telephone interview.

Power Earnings Impact

Natural gas fell today on investor concerns that mild winter weather in the U.S. will damp demand. Natural gas for February delivery fell 18.2 cents, or 6.8 percent, to $2.488 per million British thermal units on theNew York Mercantile Exchange, the lowest settlement price since March 2002.

“You’re lowering the earnings ceiling every time natural- gas prices drop,” said Pruitt, former director of the Illinois Power Agency, which negotiates power-purchase agreements for the state’s utilities.

Price declines are expected to hurt fourth-quarter 2011 earnings and continue to depress profits through 2012, Angie Storozynski, a New York City-based utilities analyst with Macquarie Capital USA Inc., said in a Jan. 11 research note.

Hardest hit will be independent power producers in unregulated states such as Texas and Illinois, which don’t have the protections given regulated utilities where states allow a certain level of profits.

60 Percent Decline

The Standard & Poor’s independent power producer index, which groups Constellation Energy Group Inc. (CEG), NRG Energy Inc. (NRG) and AES Corp. (AES), has fallen 60 percent since the beginning of 2008, compared with a 14 percent drop for the Standard & Poor’s 500 Index, according to data compiled by Bloomberg.

Low gas prices drained the momentum from a resurging nuclear industry long before last year’s meltdowns at the Fukushima Dai-Ichi plants in Japan, said Paul Patterson, a New York City-based utility analyst with Glenrock Associates LLC. No applications to build new reactors have been filed with federal regulators since June 2009.

Exelon, the largest U.S. nuclear operator, canceled plans last summer to boost capacity at two nuclear plants in Illinois and Pennsylvania after analyzing economic factors, Marshall Murphy, a spokesman for Chicago-based Exelon, said in an e-mail.

CMS Energy’s canceled coal plant, planned for Bay City, Michigan, would have showcased the newest pollution-control technology for capturing and storing carbon-dioxide emissions.

Wind Expansion Slows

Investors also are cooling on wind investment because of falling power prices, a lack of transmission infrastructure and the possibility that federal subsidies may expire next year. T. Boone Pickens, one of wind power’s biggest boosters, decided to focus on promoting gas-fueled trucking fleets after canceling plans for a Texas wind farm in 2010.

“Boone still sees wind being a key part of America’s energy future,” Jay Rosser, a spokesman for Pickens, said in an e-mail. “Natural-gas prices will ultimately rise and make wind energy more competitive in the process.”

NextEra didn’t include new U.S. wind projects in its financial forecast for 2013, Lew Hay, chief executive officer of the Juno Beach, Florida-based company, said in a November conference call with investors. NextEra’s wind expansion after 2012, when a federal tax credit for wind generators is expected to expire, is contingent upon “public policy support,” said Steve Stengel, a spokesman for NextEra, in a telephone interview.

“Wind on its own without incentives is far from economic unless gas is north of $6.50,” said Travis Miller, a Chicago- based utility analyst at Morningstar Inc. (MORN)

Shale Gas Boom

U.S. gas supplies have been growing since producers learned how to use hydraulic fracturing and horizontal drilling to tap deposits locked in dense shale rock formations. Gas prices have been falling since mid-2008, when a global recession sapped demand just as drilling accelerated in the gas-rich Marcellus shale in the eastern U.S., according to data compiled by Bloomberg.

Gas prices collapsed further in late 2011 on concerns mild winter weather in the U.S. will curb demand for the heating fuel. Gas is expected to stay below 2011’s average price of $4.026 for the next two years, priced at around $3.10 per million British thermal units for 2012 and $4 for 2013, according to Robert W. Baird (BADC) & Co., an investment bank based in Milwaukee.

New Gas Generation

Declining power prices may also make it unprofitable for utilities to install pollution controls on older coal-fired plants, adding to the wave of plant closures that are expected to result from new U.S. Environmental Protection Agency rules over the next two to three years, Pruitt said.

As much as 90 gigawatts of new generation, enough capacity to light 72 million homes and businesses, will be needed by 2015 to replace retiring coal plants and meet electricity demand, according to a Nov. 30 research report by Hugh Wynne, an analyst at investment bank Sanford C. Bernstein.

Cheap gas makes it difficult for rival forms of fuel to compete, said Sam Brothwell, a senior utility analyst with Bloomberg Industries, in a telephone interview. Historically, gas-fired generators have been the least expensive to build, offset by a higher fuel cost, Brothwell said. With gas falling below $3, “it makes all other forms of producing electricity look less competitive by comparison,” he said.

Gas Power Costs

The cost, including construction, to produce one megawatt hour of gas-fueled electricity was $62.37 an hour in the third quarter of 2011, which was less expensive than coal, wind and solar generators, according to data compiled by Bloomberg.

Power companies are leery of becoming too dependent on gas, which historically has had the biggest price swings of all the power fuels. In 2005, gas prices climbed to nearly $14 after hurricanes disrupted production in the Gulf of Mexico.

Project cancellations, along with a broader switch from coal to gas, will leave the industry with fewer alternatives and thus more exposed to rising gas prices, Pruitt said.

“The way to make $4 gas $8 gas is for everyone to go out and build combined-cycle natural-gas plants,” Michael Morris, non-executive chairman of American Electric Power (AEP) Inc., said at an industry conference in November. “We need to be cautious about how we go about this.”

To contact the reporters on this story: Julie Johnsson in Chicago at jjohnsson@bloomberg.net; Mark Chediak in San Francisco at mchediak@bloomberg.net

- Mensagens: 87

- Registado: 9/8/2011 19:58

Entretanto está a começar uma luta de interesses entre a indústria Americana e os produtores de gás, com estes últimos a enfrentarem a oposição da indústria Americana aos planos de exportação de gás, com o receio óbvio que lhes venha a retirar os actuais preços. Começou já o lobby para que a agência de energia não atribua as licenças de exportação.

A intenção das empresas de energia é reconverter os terminais de importação de LNG, que começam a ficar ás moscas, em terminais de exportação, para tentar rentabilizar os “miles milhões” investidos na construção destes terminais nos últimos anos.

http://online.wsj.com/article/SB1000142 ... 31530.html

Gas Exports Ignite a Feud

US officials will soon weigh in on a fight between companies that want to export some of America's fast-growing supply of natural gas and big manufacturers that oppose the exports because they rely on cheap domestic gas.

In the next few weeks, Washington's number-crunchers are set to estimate whether exports would cause US prices to swell—a finding they will use in deciding the fate of more than a half-dozen projects across the nation.

The battle, which pits manufacturers such as Dow Chemical Co. against energy producers like ConocoPhillips, shows how the boom in US fossil-fuel production is upending markets and forcing policy makers into decisions they didn't imagine facing just a few years ago.

Once seen as a likely significant importer of natural gas—before the boom in domestic shale-gas production provided enough to meet demand—the US is now emerging as a potential supplier of the fuel to nations overseas thanks to the newly tapped sources in shale.

Companies are setting their sights on markets in Europe and Asia where natural gas fetches three to four times the price in the US According to Platt's, natural gas in Japan and South Korea fetches more than $16 per million British thermal units, compared with a benchmark price of a little more than $3 per million BTUs in the US The companies are looking to spend billions of dollars on new terminals that could ship out about 17% of US daily production, or about 11 billion cubic feet per day, according to the Energy Department. But Dow Chemical and others say allowing exports will crimp the supply available to US users and drive up prices here.

To send natural gas across the oceans, companies must supercool the fuel to minus 260 degrees and convert it to liquid form so it can be loaded onto tankers. Building massive coastal facilities to make liquefied natural gas requires multiple permits from Washington.

The Energy Department is looking at whether exports will drain US supplies and inflate domestic prices. The Energy Information Administration, part of the department, is expected to deliver its analysis in a few weeks.

If the department finds export terminals will raise the domestic price of natural gas and fail to serve the country's best interests, it could block applicants from exporting to most nations except those with free-trade agreements with the US That could doom the projects.

Sen. Ron Wyden (D., Ore.), whose state includes one of the proposed terminals, says he is concerned US consumers and businesses will get "short shrift" if natural gas supplies are shipped abroad.

"If you see natural gas prices go into the stratosphere, it would make it difficult for other industries to create jobs in the United States," Mr. Wyden said in an interview.

Among those taking a hit would be chemical companies, which use natural gas as a raw material in car parts, bottles, cleaners, mattresses and other products. Dow Chemical, one of the most outspoken critics of the export proposals, says the US would be better off using its cheap natural gas for domestic manufacturing instead of exports.

"When natural gas is used as a chemical raw material, it creates eight times the value compared to other uses, and fuels higher-paying jobs, exports of finished goods and the vitality of the manufacturing sector," Dow spokeswoman Kasey Anderson said.

Energy companies say there is plenty of natural gas in the US to meet domestic demand and support exports at the same time. They say building the giant export facilities would create construction jobs and boost long-term employment by encouraging a faster rise in US natural-gas output.

"American consumers are best served when markets rather than regulators determine outcomes," said Cheniere Energy Inc. spokesman Andrew Ware.

While concern over price increases "gets the most airplay," the Energy Department is also examining potential benefits of exports, such as creating jobs and offsetting the large US trade deficit, said Chris Smith, the department's assistant secretary for oil and gas.

Cheniere, which wants to start construction in 2012 on an export facility in Louisiana, is the only company to have cleared the Energy Department hurdle on exports. It got approval to export to most nations in May, before opponents had fully geared up to resist such plans. Cheniere has already signed long-term contracts to supply natural gas to the UK's BG Group PLC, Spain's Gas Natural Fenosa and GAIL (India) Ltd.

Many companies that are seeking permission to export natural gas had planned to import it just a few years ago. Then US production rose 18% between 2005 and 2010, with the bulk of the increase coming from gas trapped in rock formations known as shale.

Import terminals are now gathering dust. Earlier this year, a terminal owned by Dominion Resources Inc. south of Baltimore had to buy a shipment of natural gas from overseas just to keep its equipment running.

With natural gas prices in the US at multiyear lows, power companies can generate electricity more cheaply and pass the savings to consumers.

A study by Navigant Consulting Inc. found three of the export projects the government is studying could together increase domestic prices by 17% in 2020, with the impact declining over time as more natural gas is produced.

Deloitte, which looked at a separate set of three projects, said the long-term rise in prices would be much smaller.

Charles Ebinger of the Brookings Institution says the impact of exports on prices is "virtually an impossible question" because there are so many hard-to-measure variables. One is whether the popular drilling technique known as hydraulic fracturing continues to grow—boosting natural-gas supply and keeping prices down—or gets bogged down in safety questions."

A intenção das empresas de energia é reconverter os terminais de importação de LNG, que começam a ficar ás moscas, em terminais de exportação, para tentar rentabilizar os “miles milhões” investidos na construção destes terminais nos últimos anos.

http://online.wsj.com/article/SB1000142 ... 31530.html

Gas Exports Ignite a Feud

US officials will soon weigh in on a fight between companies that want to export some of America's fast-growing supply of natural gas and big manufacturers that oppose the exports because they rely on cheap domestic gas.

In the next few weeks, Washington's number-crunchers are set to estimate whether exports would cause US prices to swell—a finding they will use in deciding the fate of more than a half-dozen projects across the nation.

The battle, which pits manufacturers such as Dow Chemical Co. against energy producers like ConocoPhillips, shows how the boom in US fossil-fuel production is upending markets and forcing policy makers into decisions they didn't imagine facing just a few years ago.

Once seen as a likely significant importer of natural gas—before the boom in domestic shale-gas production provided enough to meet demand—the US is now emerging as a potential supplier of the fuel to nations overseas thanks to the newly tapped sources in shale.

Companies are setting their sights on markets in Europe and Asia where natural gas fetches three to four times the price in the US According to Platt's, natural gas in Japan and South Korea fetches more than $16 per million British thermal units, compared with a benchmark price of a little more than $3 per million BTUs in the US The companies are looking to spend billions of dollars on new terminals that could ship out about 17% of US daily production, or about 11 billion cubic feet per day, according to the Energy Department. But Dow Chemical and others say allowing exports will crimp the supply available to US users and drive up prices here.

To send natural gas across the oceans, companies must supercool the fuel to minus 260 degrees and convert it to liquid form so it can be loaded onto tankers. Building massive coastal facilities to make liquefied natural gas requires multiple permits from Washington.

The Energy Department is looking at whether exports will drain US supplies and inflate domestic prices. The Energy Information Administration, part of the department, is expected to deliver its analysis in a few weeks.

If the department finds export terminals will raise the domestic price of natural gas and fail to serve the country's best interests, it could block applicants from exporting to most nations except those with free-trade agreements with the US That could doom the projects.

Sen. Ron Wyden (D., Ore.), whose state includes one of the proposed terminals, says he is concerned US consumers and businesses will get "short shrift" if natural gas supplies are shipped abroad.

"If you see natural gas prices go into the stratosphere, it would make it difficult for other industries to create jobs in the United States," Mr. Wyden said in an interview.

Among those taking a hit would be chemical companies, which use natural gas as a raw material in car parts, bottles, cleaners, mattresses and other products. Dow Chemical, one of the most outspoken critics of the export proposals, says the US would be better off using its cheap natural gas for domestic manufacturing instead of exports.

"When natural gas is used as a chemical raw material, it creates eight times the value compared to other uses, and fuels higher-paying jobs, exports of finished goods and the vitality of the manufacturing sector," Dow spokeswoman Kasey Anderson said.

Energy companies say there is plenty of natural gas in the US to meet domestic demand and support exports at the same time. They say building the giant export facilities would create construction jobs and boost long-term employment by encouraging a faster rise in US natural-gas output.

"American consumers are best served when markets rather than regulators determine outcomes," said Cheniere Energy Inc. spokesman Andrew Ware.

While concern over price increases "gets the most airplay," the Energy Department is also examining potential benefits of exports, such as creating jobs and offsetting the large US trade deficit, said Chris Smith, the department's assistant secretary for oil and gas.

Cheniere, which wants to start construction in 2012 on an export facility in Louisiana, is the only company to have cleared the Energy Department hurdle on exports. It got approval to export to most nations in May, before opponents had fully geared up to resist such plans. Cheniere has already signed long-term contracts to supply natural gas to the UK's BG Group PLC, Spain's Gas Natural Fenosa and GAIL (India) Ltd.

Many companies that are seeking permission to export natural gas had planned to import it just a few years ago. Then US production rose 18% between 2005 and 2010, with the bulk of the increase coming from gas trapped in rock formations known as shale.

Import terminals are now gathering dust. Earlier this year, a terminal owned by Dominion Resources Inc. south of Baltimore had to buy a shipment of natural gas from overseas just to keep its equipment running.

With natural gas prices in the US at multiyear lows, power companies can generate electricity more cheaply and pass the savings to consumers.

A study by Navigant Consulting Inc. found three of the export projects the government is studying could together increase domestic prices by 17% in 2020, with the impact declining over time as more natural gas is produced.

Deloitte, which looked at a separate set of three projects, said the long-term rise in prices would be much smaller.

Charles Ebinger of the Brookings Institution says the impact of exports on prices is "virtually an impossible question" because there are so many hard-to-measure variables. One is whether the popular drilling technique known as hydraulic fracturing continues to grow—boosting natural-gas supply and keeping prices down—or gets bogged down in safety questions."

- Mensagens: 87

- Registado: 9/8/2011 19:58

obs: para quem não consegue abrir os artigos do Financial Times, o truque é pesquisar o titulo do artigo no google, e clicar de seguida na opção "traduzir esta página" do google que já abre.

Depois de aberto podem clicar na opção original no canto superior direito para lerem na língua original.

Depois de aberto podem clicar na opção original no canto superior direito para lerem na língua original.

- Mensagens: 87

- Registado: 9/8/2011 19:58

http://www.ft.com/cms/s/0/8394bc82-481e ... z1keEspEOQ

"North American industrial companies are predicting that the US will be one of their big growth markets in 2012 for the first time since the start of the financial crisis, reflecting rising demand for everything from excavators to truck parts."

"It's the oil stupid"

"It's cheap energy stupid"

"North American industrial companies are predicting that the US will be one of their big growth markets in 2012 for the first time since the start of the financial crisis, reflecting rising demand for everything from excavators to truck parts."

"It's the oil stupid"

"It's cheap energy stupid"

- Mensagens: 87

- Registado: 9/8/2011 19:58

Financial Times

"China and France chase US shale assets"

http://www.ft.com/intl/cms/s/0/30c4c46e ... z1ke9PW330

Os Chineses como não podem ver nada e não querem ficar para trás na energia barata, estão já a começar com a exploração do shale gás com a fractura hidraulica:

"Chinese shale gas developments herald major US industrial export opportunities"

http://www.ft.com/intl/cms/s/2/bc3b52f2 ... z1ke9PW330

Os "burros" dos Americanos vão lá facturar 1 ano ou 2 a fornecer a tecnologia e a seguir levam um xuto no rabinho.

Valha-nos a Polónia na Europa, que está a avançar com a ajuda das empresas Americanas. O problema deles é que a Alemanha anda com ideias de propor a proibição da fractura hidráulica na união Europeia.

"China and France chase US shale assets"

http://www.ft.com/intl/cms/s/0/30c4c46e ... z1ke9PW330

Os Chineses como não podem ver nada e não querem ficar para trás na energia barata, estão já a começar com a exploração do shale gás com a fractura hidraulica:

"Chinese shale gas developments herald major US industrial export opportunities"

http://www.ft.com/intl/cms/s/2/bc3b52f2 ... z1ke9PW330

Os "burros" dos Americanos vão lá facturar 1 ano ou 2 a fornecer a tecnologia e a seguir levam um xuto no rabinho.

Valha-nos a Polónia na Europa, que está a avançar com a ajuda das empresas Americanas. O problema deles é que a Alemanha anda com ideias de propor a proibição da fractura hidráulica na união Europeia.

Editado pela última vez por upanddown em 27/1/2012 10:28, num total de 2 vezes.

- Mensagens: 87

- Registado: 9/8/2011 19:58

Atenção, o petróleo do xisto é petróleo leve!!!

http://www.reuters.com/article/2012/01/ ... LE20120124

U.S. oil production to surge on shale output: EIA

"The big loser will likely be West Africa, who will find their light sweet barrels they export to the U.S. replaced by shale," said Sarah Emerson of Energy Security Analysis, Inc.

(Reuters) - A boom in shale oil production will raise U.S. domestic crude output by a fifth over the next decade, helping to slash the country's dependence on foreign oil imports, the U.S. Energy Information Administration said on Monday.

Growing shale production as well as Gulf of Mexico development will boost U.S. crude oil production by more than 20 percent to 6.7 million barrels per day in 2020 from 5.5 million bpd in 2010, the EIA said in its annual domestic energy outlook.

That would mark the highest level of U.S. oil output since 1994, thanks to advances in drilling techniques that have opened the door to tapping the nation's vast shale reserves.

The EIA's forecast for U.S. oil production is 11 percent higher than its previous estimate.

Shale oil production made up 21 percent of output in the lower 48 states in 2010. By 2035, such production will account for 31 percent of that output.

While oil production is expected to slow after 2020, output will remain above 6.1 million bpd through 2035, the EIA said.

IMPORTS TAKE PLUNGE

U.S. oil imports are expected to drop to 36 percent of total consumption by 2035 from 49 percent in 2010 as production rises while demand is limited by modest economic growth plus higher vehicle efficiency standards, according to the EIA report.

"The big loser will likely be West Africa, who will find their light sweet barrels they export to the U.S. replaced by shale," said Sarah Emerson of Energy Security Analysis, Inc.

Emerson said Latin American oil suppliers have more long-term contracts and connections to U.S. refineries that are suited to handle their heavier crude oil.

"Eventually even Persian Gulf crude could take a hit, but it'll take a while - at least 5 years," she said.

The EIA did not factor in the newest proposed efficiency standards for vehicles from 2017 to 2025, which the agency said could reduce demand for oil imports even further.

The surge in shale oil production will not be affected much by the Obama administration's decision to reject TransCanada's Keystone XL pipeline, EIA head Howard Gruenspecht said.

Oil drillers had looked to the project, who's future is now uncertain, to help move oil produced from shale resources.

"Given the prices projected in the report, we don't think that production is dependent any particular pipeline," Gruenspecht said at an event unveiling the report.

SHIFT TO OIL

The search for higher-value energy resources has prompted companies such as Chesapeake (CHK.N) and Halliburton (HAL.N) to shift drilling from "dry gas" fields to those that are "liquids-rich," meaning they contain oil or natural gas liquids such as propane, butane or ethane, whose prices are based on those of crude oil.

Matt Smith, an analyst with Summit Energy, said Chesapeake's announcement on Monday that it will cut its daily natural gas output should not significantly affect production going forward.

"Although this is obviously an indication that low prices are going hamper production somewhat, we are still seeing near record production," Smith said. "Especially once the reality of LNG comes into focus, it seems this really shouldn't impact production over the longer term."

The EIA said it expects the United States will produce 7 percent more natural gas between 2010 and 2035 than previously projected.

Despite significantly lowering its estimate for U.S. shale gas reserves, U.S. natural gas output is projected to hit 27.9 tcf in 2035, up from 21.65 tcf in 2010.

The EIA's estimate for unproved technically recoverable shale gas in the United States is now 482 trillion cubic feet, down from the 827 tcf estimated in last year's report.

Strong natural gas output will fuel exports of liquefied natural gas, with the United States becoming a net exporter of LNG in 2016 at a capacity of 1.1 billion cubic feet, the EIA said. LNG export capacity is expected to rise by an additional 1.1 bcf in 2019.

Não esquecer que o boom que vai acontecer agora em shale oil já está a acontecer em força com o shale gas.

http://www.reuters.com/article/2012/01/ ... LE20120124

U.S. oil production to surge on shale output: EIA

"The big loser will likely be West Africa, who will find their light sweet barrels they export to the U.S. replaced by shale," said Sarah Emerson of Energy Security Analysis, Inc.

(Reuters) - A boom in shale oil production will raise U.S. domestic crude output by a fifth over the next decade, helping to slash the country's dependence on foreign oil imports, the U.S. Energy Information Administration said on Monday.

Growing shale production as well as Gulf of Mexico development will boost U.S. crude oil production by more than 20 percent to 6.7 million barrels per day in 2020 from 5.5 million bpd in 2010, the EIA said in its annual domestic energy outlook.

That would mark the highest level of U.S. oil output since 1994, thanks to advances in drilling techniques that have opened the door to tapping the nation's vast shale reserves.

The EIA's forecast for U.S. oil production is 11 percent higher than its previous estimate.

Shale oil production made up 21 percent of output in the lower 48 states in 2010. By 2035, such production will account for 31 percent of that output.

While oil production is expected to slow after 2020, output will remain above 6.1 million bpd through 2035, the EIA said.

IMPORTS TAKE PLUNGE

U.S. oil imports are expected to drop to 36 percent of total consumption by 2035 from 49 percent in 2010 as production rises while demand is limited by modest economic growth plus higher vehicle efficiency standards, according to the EIA report.

"The big loser will likely be West Africa, who will find their light sweet barrels they export to the U.S. replaced by shale," said Sarah Emerson of Energy Security Analysis, Inc.

Emerson said Latin American oil suppliers have more long-term contracts and connections to U.S. refineries that are suited to handle their heavier crude oil.

"Eventually even Persian Gulf crude could take a hit, but it'll take a while - at least 5 years," she said.

The EIA did not factor in the newest proposed efficiency standards for vehicles from 2017 to 2025, which the agency said could reduce demand for oil imports even further.

The surge in shale oil production will not be affected much by the Obama administration's decision to reject TransCanada's Keystone XL pipeline, EIA head Howard Gruenspecht said.

Oil drillers had looked to the project, who's future is now uncertain, to help move oil produced from shale resources.

"Given the prices projected in the report, we don't think that production is dependent any particular pipeline," Gruenspecht said at an event unveiling the report.

SHIFT TO OIL

The search for higher-value energy resources has prompted companies such as Chesapeake (CHK.N) and Halliburton (HAL.N) to shift drilling from "dry gas" fields to those that are "liquids-rich," meaning they contain oil or natural gas liquids such as propane, butane or ethane, whose prices are based on those of crude oil.

Matt Smith, an analyst with Summit Energy, said Chesapeake's announcement on Monday that it will cut its daily natural gas output should not significantly affect production going forward.

"Although this is obviously an indication that low prices are going hamper production somewhat, we are still seeing near record production," Smith said. "Especially once the reality of LNG comes into focus, it seems this really shouldn't impact production over the longer term."

The EIA said it expects the United States will produce 7 percent more natural gas between 2010 and 2035 than previously projected.

Despite significantly lowering its estimate for U.S. shale gas reserves, U.S. natural gas output is projected to hit 27.9 tcf in 2035, up from 21.65 tcf in 2010.

The EIA's estimate for unproved technically recoverable shale gas in the United States is now 482 trillion cubic feet, down from the 827 tcf estimated in last year's report.

Strong natural gas output will fuel exports of liquefied natural gas, with the United States becoming a net exporter of LNG in 2016 at a capacity of 1.1 billion cubic feet, the EIA said. LNG export capacity is expected to rise by an additional 1.1 bcf in 2019.

Não esquecer que o boom que vai acontecer agora em shale oil já está a acontecer em força com o shale gas.

- Mensagens: 87

- Registado: 9/8/2011 19:58

Já agora, deixo este pequeno texto do wikipédia que esclarece a diferença e que explica que se tratam de coisas em estados geológicos/químicos diferentes:

Oil shale, an organic-rich sedimentary rock, belongs to the group of sapropel fuels.[11] It does not have a definite geological definition nor a specific chemical formula, and its seams do not always have discrete boundaries. Oil shales vary considerably in their mineral content, chemical composition, age, type of kerogen, and depositional history and not all oil shales would necessarily be classified as shales in the strict sense.[12] Oil shale differs from bitumen-impregnated rocks (oil sands and petroleum reservoir rocks), humic coals and carbonaceous shale. While oil sands originate from the biodegradation of oil, heat and pressure have not (yet) transformed the kerogen in oil shale into petroleum.

FLOP - Fundamental Laws Of Profit

1. Mais vale perder um ganho que ganhar uma perda, a menos que se cumpra a Segunda Lei.

2. A expectativa de ganho deve superar a expectativa de perda, onde a expectativa mede a

__.amplitude média do ganho/perda contra a respectiva probabilidade.

3. A Primeira Lei não é mesmo necessária mas com Três Leis isto fica definitivamente mais giro.

Elias Escreveu:Mas o crude do Canadá não é leve... tenho ideia que é do mais pesado... isso nao é shale oil?

Não, "Oil Shale" como refiro acima são depósitos de pedra sedimentar ricos em hidrocarbonetos. Dali consegue-se sintetizar vários produtos como "shale oil" e "shale gas". E também poderão conter gás natural.

Já as reservas do Canadá são de petróleo mesmo (e depois de petróleo há muitas qualidades). Suponho que estás a referir-te às reservas de areia betuminosa, mas o que essas reservas canadianas são ricas em "heavy crude", não é a mesma coisa.

FLOP - Fundamental Laws Of Profit

1. Mais vale perder um ganho que ganhar uma perda, a menos que se cumpra a Segunda Lei.

2. A expectativa de ganho deve superar a expectativa de perda, onde a expectativa mede a

__.amplitude média do ganho/perda contra a respectiva probabilidade.

3. A Primeira Lei não é mesmo necessária mas com Três Leis isto fica definitivamente mais giro.

Elias Escreveu:Eu tinha ideia que o Canadá também tinha grandes reservas... ou não é bem disto?

O Canadá tem grandes reservas de crude, é o terceiro a nível mundial em termos de reservas conhecidas.

Quanto a depósitos de Oil Shale, pode ver-se aqui uma listagem de reservas conhecidas por país e zona do globo:

http://en.wikipedia.org/wiki/Oil_shale_ ... allocation

FLOP - Fundamental Laws Of Profit

1. Mais vale perder um ganho que ganhar uma perda, a menos que se cumpra a Segunda Lei.

2. A expectativa de ganho deve superar a expectativa de perda, onde a expectativa mede a

__.amplitude média do ganho/perda contra a respectiva probabilidade.

3. A Primeira Lei não é mesmo necessária mas com Três Leis isto fica definitivamente mais giro.

MarcoAntonio Escreveu:As maiores jazidas conhecidas encontram-se nos Estados Unidos (cerca de 80% mais coisa menos coisa de todas as reservas conhecidas).

Eu tinha ideia que o Canadá também tinha grandes reservas... ou não é bem disto?

- Mensagens: 35428

- Registado: 5/11/2002 12:21

- Localização: Barlavento

MarcoAntonio Escreveu:O problema aqui é mais a precisão dos termos, que tendem a gerar confusão.

Oil Shale basicamente são jazidas - ou depósitos - de pedra sedimentar ricas em hidrocarbonetos das quais se podem retirar várias coisas (entre elas inclui-se "gás natural" inclusivamente).

As maiores jazidas conhecidas encontram-se nos Estados Unidos (cerca de 80% mais coisa menos coisa de todas as reservas conhecidas).

Há jazidas a ser exploradas em diversos países noutros pontos do planeta (incluindo aqueles que o MAV8 refere) mas como referi atrás, podem extrair-se várias coisas desde "gás natural" (convencional) a "shale oil" (que é sintetizado a partir do "oil shale") e a terminar em "shale gas" (ou mais especificamente para evitar confusões, "oil shale gas").

É este último "oil shale gas" que actualmente, salvo erro, só é explorado comercialmente nos Estados Unidos (contudo a Estónia - que tem as mais importantes reservas conhecidas na Europa - já produziu "oil shale gas" no passado pelo menos).

Há vários países no entanto a produzir "shale oil" (petróleo sintético a partir de Oil Shale).

Exatamente, nem mais. Só para reforçar a ideia no meu último post explica isso tudo, é só ler com atenção - modo de produção de shale oil a partir de oil shale e história de produção de shale oil.

MAV8

Carteira 69

Carteira 69

O problema aqui é mais a precisão dos termos, que tendem a gerar confusão.

Oil Shale basicamente são jazidas - ou depósitos - de pedra sedimentar ricas em hidrocarbonetos das quais se podem retirar várias coisas (entre elas inclui-se "gás natural" inclusivamente).

As maiores jazidas conhecidas encontram-se nos Estados Unidos (cerca de 80% mais coisa menos coisa de todas as reservas conhecidas).

Há jazidas a ser exploradas em diversos países noutros pontos do planeta (incluindo aqueles que o MAV8 refere) mas como referi atrás, podem extrair-se várias coisas desde "gás natural" (convencional) a "shale oil" (que é sintetizado a partir do "oil shale") e a terminar em "shale gas" (ou mais especificamente para evitar confusões, "oil shale gas").

É este último "oil shale gas" que actualmente, salvo erro, só é explorado comercialmente nos Estados Unidos (contudo a Estónia - que tem as mais importantes reservas conhecidas na Europa - já produziu "oil shale gas" no passado pelo menos).

Há vários países no entanto a produzir "shale oil" (petróleo sintético a partir de Oil Shale).

Oil Shale basicamente são jazidas - ou depósitos - de pedra sedimentar ricas em hidrocarbonetos das quais se podem retirar várias coisas (entre elas inclui-se "gás natural" inclusivamente).

As maiores jazidas conhecidas encontram-se nos Estados Unidos (cerca de 80% mais coisa menos coisa de todas as reservas conhecidas).

Há jazidas a ser exploradas em diversos países noutros pontos do planeta (incluindo aqueles que o MAV8 refere) mas como referi atrás, podem extrair-se várias coisas desde "gás natural" (convencional) a "shale oil" (que é sintetizado a partir do "oil shale") e a terminar em "shale gas" (ou mais especificamente para evitar confusões, "oil shale gas").

É este último "oil shale gas" que actualmente, salvo erro, só é explorado comercialmente nos Estados Unidos (contudo a Estónia - que tem as mais importantes reservas conhecidas na Europa - já produziu "oil shale gas" no passado pelo menos).

Há vários países no entanto a produzir "shale oil" (petróleo sintético a partir de Oil Shale).

FLOP - Fundamental Laws Of Profit

1. Mais vale perder um ganho que ganhar uma perda, a menos que se cumpra a Segunda Lei.

2. A expectativa de ganho deve superar a expectativa de perda, onde a expectativa mede a

__.amplitude média do ganho/perda contra a respectiva probabilidade.

3. A Primeira Lei não é mesmo necessária mas com Três Leis isto fica definitivamente mais giro.

"Shale oil extraction process decomposes oil shale and converts its kerogen into shale oil—a petroleum-like synthetic crude oil. The process is conducted by pyrolysis, hydrogenation, or thermal dissolution. The efficiencies of extraction processes are often evaluated by comparing their yields to the results of a Fischer Assay performed on a sample of the shale."

"Shale oil extraction is an industrial process for unconventional oil production. This process converts kerogen in oil shale into shale oil by pyrolysis, hydrogenation, or thermal dissolution. The resultant shale oil is used as fuel oil or upgraded to meet refinery feedstock specifications by adding hydrogen and removing sulfur and nitrogen impurities.

Shale oil extraction is usually performed above ground (ex situ processing) by mining the oil shale and then treating it in processing facilities. Other modern technologies perform the processing underground (on-site or in situ processing) by applying heat and extracting the oil via oil wells.

The earliest description of the process dates to the 10th century. In 1684, Great Britain granted the first formal extraction process patent. Extraction industries and innovations became widespread during the 19th century. The industry shrank in the mid-20th century following the discovery of large reserves of conventional oil, but high petroleum prices at the beginning of the 21st century have led to renewed interest, accompanied by the development and testing of newer technologies.

As of 2010, major long-standing extraction industries are operating in Estonia, Brazil, and China. Its economic viability usually requires a lack of locally available crude oil. National energy security issues have also played a role in its development. Critics of shale oil extraction pose questions about environmental management issues, such as waste disposal, extensive water use, waste water management, and air pollution."

"Shale oil extraction is an industrial process for unconventional oil production. This process converts kerogen in oil shale into shale oil by pyrolysis, hydrogenation, or thermal dissolution. The resultant shale oil is used as fuel oil or upgraded to meet refinery feedstock specifications by adding hydrogen and removing sulfur and nitrogen impurities.

Shale oil extraction is usually performed above ground (ex situ processing) by mining the oil shale and then treating it in processing facilities. Other modern technologies perform the processing underground (on-site or in situ processing) by applying heat and extracting the oil via oil wells.

The earliest description of the process dates to the 10th century. In 1684, Great Britain granted the first formal extraction process patent. Extraction industries and innovations became widespread during the 19th century. The industry shrank in the mid-20th century following the discovery of large reserves of conventional oil, but high petroleum prices at the beginning of the 21st century have led to renewed interest, accompanied by the development and testing of newer technologies.

As of 2010, major long-standing extraction industries are operating in Estonia, Brazil, and China. Its economic viability usually requires a lack of locally available crude oil. National energy security issues have also played a role in its development. Critics of shale oil extraction pose questions about environmental management issues, such as waste disposal, extensive water use, waste water management, and air pollution."

MAV8

Carteira 69

Carteira 69

O fim da indexação do preço do gás ao preço do petróleo no States:

http://mjperry.blogspot.com/2011/11/cha ... rices.html

The shale gold rush:

http://video.foxnews.com/v/3960671/shale-gold-rush/

http://thepurplevioletpressnb.blogspot. ... h-for.html

http://www.desmogblog.com/natural-gas-g ... ohn-kasich

Shale-Gas Drilling to Add 870,000 U.S. Jobs by 2015, Report Says

http://www.businessweek.com/news/2011-1 ... -says.html

Wall Street Journal

It's Official: 'Age of Shale' Has Arrived

http://online.wsj.com/article/SB1000142 ... 24656.html

Drill baby drill ...

http://mjperry.blogspot.com/2011/11/cha ... rices.html

The shale gold rush:

http://video.foxnews.com/v/3960671/shale-gold-rush/

http://thepurplevioletpressnb.blogspot. ... h-for.html

http://www.desmogblog.com/natural-gas-g ... ohn-kasich

Shale-Gas Drilling to Add 870,000 U.S. Jobs by 2015, Report Says

http://www.businessweek.com/news/2011-1 ... -says.html

Wall Street Journal

It's Official: 'Age of Shale' Has Arrived

http://online.wsj.com/article/SB1000142 ... 24656.html

Drill baby drill ...

- Mensagens: 87

- Registado: 9/8/2011 19:58

MAV8 Escreveu:A china, a Estónia e o Brasil foram lideres mundiais de produção de shale oil durante muitos anos.

Os estados unidos estão agora a atingir os niveis de produção daqueles 3.

Não são os Chineses que vão buscar o Know How`aos USA mas sim o contrário. Aliás se não estou em erro a Estónia ainda produz cerca de 1/3 da produção mundial.

Já agora, uma curiosidade:

A Escocia já extraia e produzia shale oil em 1880 !!! e durante muitos anos foram os únicos a fazê-lo.

looool para cereja no topo do bolo só faltava dizer que Portugal também produz.

Mais uma vez não confundir "shale oil" com "oil shale".

E já se sabe há muito tempo da sua existência, simplesmente não havia forma eficaz de o extrair. A perfuração horizontal e fractura hidráulica que está a ser feita nos states (e foi desenvolvida lá) é que permite a extracção em quantidades industriais (primeiro foi apenas com o gás e agora começou com o petroleo).

Quanto à China palavras para quê?

China shale gas boom could surpass U.S. - Sinopec

http://www.reuters.com/article/2011/12/ ... 5Y20111207

http://peakoil.com/geology/petrochina-f ... -reserves/

"China does not yet have any shale gas wells producing commercially, but several companies have exploratory projects underway, including Sinopec, PetroChina, Royal Dutch Shell, BP and Chevron. China has more shale gas reserves than any other country in the world, with 1,275tr cu ft of recoverable shale gas reserves, according to estimates from the US Energy Information Administration. That is enough to supply China for more than 300 years, based on current consumption levels."

China Plans Subsidies to Tap Shale Gas Reserves Larger Than U.S.

http://www.businessweek.com/news/2011-1 ... -u-s-.html

- Mensagens: 87

- Registado: 9/8/2011 19:58

A china, a Estónia e o Brasil foram lideres mundiais de produção de shale oil durante muitos anos.

Os estados unidos estão agora a atingir os niveis de produção daqueles 3.

Não são os Chineses que vão buscar o Know How`aos USA mas sim o contrário. Aliás se não estou em erro a Estónia ainda produz cerca de 1/3 da produção mundial.

Já agora, uma curiosidade :

:

A Escocia já extraia e produzia shale oil em 1880 !!! e durante muitos anos foram os únicos a fazê-lo.

Os estados unidos estão agora a atingir os niveis de produção daqueles 3.

Não são os Chineses que vão buscar o Know How`aos USA mas sim o contrário. Aliás se não estou em erro a Estónia ainda produz cerca de 1/3 da produção mundial.

Já agora, uma curiosidade

A Escocia já extraia e produzia shale oil em 1880 !!! e durante muitos anos foram os únicos a fazê-lo.

MAV8

Carteira 69

Carteira 69

Hum... só me pergunto o que andará a GALP a fazer por causa disto.

disclaimer: isto é a minha opinião, se não gosta ponha na beira do prato. Se gosta e agir baseado nela, quero deixar claro que o está a fazer por sua única e exclusiva conta e risco.

"When it comes to money, the level of integrity is the least." - Parag Parikh

* Fight club sem nódoas negras: http://artista1939.mybrute.com

"When it comes to money, the level of integrity is the least." - Parag Parikh

* Fight club sem nódoas negras: http://artista1939.mybrute.com

Estimativas de gás de xisto na ultima coluna:

http://www.eia.gov/analysis/studies/worldshalegas/

País com maiores reservas estimadas: China

Isto é só para o gás. Depois existem as zonas com Petróleos e líquidos.

http://www.eia.gov/analysis/studies/worldshalegas/

País com maiores reservas estimadas: China

Isto é só para o gás. Depois existem as zonas com Petróleos e líquidos.

- Mensagens: 87

- Registado: 9/8/2011 19:58

Quem está ligado:

Utilizadores a ver este Fórum: A_investidor, cali010201, Eduardo R., Lisboa_Casino, Mavericks7, PAULOJOAO, simvale, tami e 184 visitantes