Crise Grega

Re: Crise Grega

O Governo grego tem a convicção de que as negociações vão decorrer muito bem. Para começar, enfiou com a Quadriga (nome dado por um jornalista -desportivo, presumo- aos representantes dos credores) num átrio de entrada (com bombeiros e tudo!).

Isto começa a parecer-se com uma ópera bufa... É o que há.

http://www.telegraph.co.uk/finance/econ ... ystem.html

Isto começa a parecer-se com uma ópera bufa... É o que há.

http://www.telegraph.co.uk/finance/econ ... ystem.html

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

lol

.

Claro que não é só a França e a Alemanha!

Claro que não é só a França e a Alemanha!

Dom_Quixote Escreveu:Schäuble em entrevista:

"Não existe qualquer supremacia alemã"

"Sem a Alemanha e a França, a coisa não funciona. Isso é o que importa."

http://www.msn.com/pt-pt/noticias/other ... lsignoutmd

"É de sábios mudar de opinião" - Miguel de Cervantes

"A verdade é o preço" - bogos in Caldeirão de Bolsa

"A verdade é o preço" - bogos in Caldeirão de Bolsa

Re: Crise Grega

Sâo os únicos que por si só têm direito de veto quando algo vai a votação, estou correcto? A zona Euro "não é só Alemanha e França", mas infelizmente cada vez mais é só "Alemanha e França" quanto a decisões importantes...Dr Tretas Escreveu:Interessante, a conversa com o Varoufakis. Mas eu se lá estivesse tinha perguntado sobre a posição de outros estados membros, a zona euro não é só Alemanha e França, ainda que nos queiram convencer que sim.

- Mensagens: 144

- Registado: 8/6/2015 21:26

Re: Crise Grega

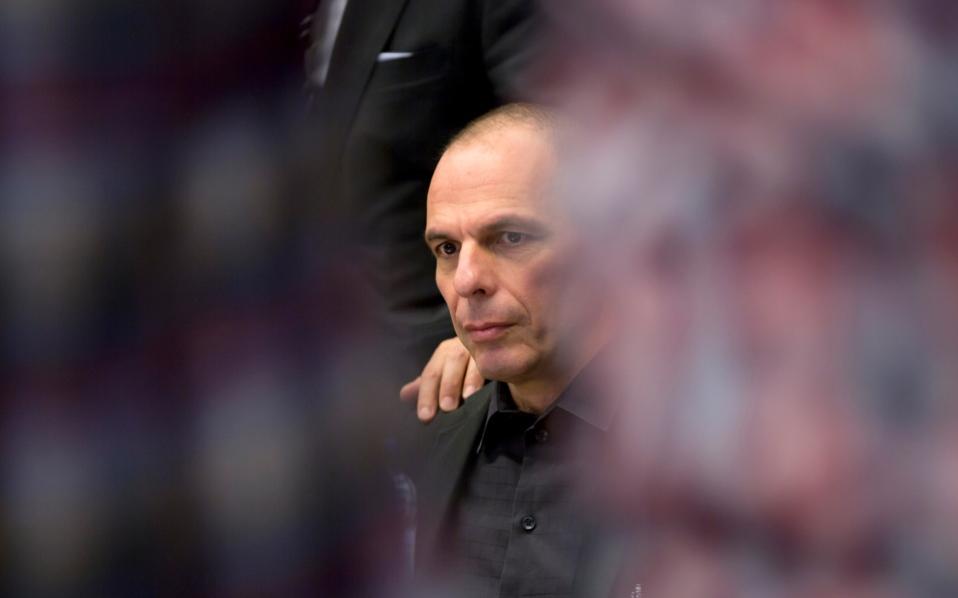

Interessante, a conversa com o Varoufakis. Mas eu se lá estivesse tinha perguntado sobre a posição de outros estados membros, a zona euro não é só Alemanha e França, ainda que nos queiram convencer que sim.

A crise grega no Kathimerini

A bolsa de Atenas continua fechada e sem data marcada para a sua reabertura. O medo da fuga de capitais e a necessidade imperiosa de salvaguardar os depósitos bancários acima de 100.000€ está a dar muito que fazer aos responsáveis do BCE e aos agentes gregos.

http://www.ekathimerini.com/199988/arti ... f-exchange

http://www.ekathimerini.com/199991/arti ... k-deposits

http://www.ekathimerini.com/199979/arti ... oodys-says

http://www.ekathimerini.com/199988/arti ... f-exchange

http://www.ekathimerini.com/199991/arti ... k-deposits

http://www.ekathimerini.com/199979/arti ... oodys-says

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

Varoufakis unplugged: the London call transcript

The London-based Official Monetary and Financial Institutions Forum, headed by two ex-Financial Times scribes – chairman John Plender and managing director David Marsh – on Monday released a 24-minute audiotape of a teleconference they held nearly two weeks ago with Yanis Varoufakis, the former Greek finance minister.

Details of the call were first revealed by the Greek daily Kathimerini, and much of most sensational revelations Varoufakis made were about a surreptitious project he and a small team of aides worked on to set up a parallel payments system that could be activated if the European Central Bank forced the shutdown of the Greek financial system.

But Varoufakis also made some other interesting allegations, including claims the International Monetary Fund believes the Greek bailout is doomed and that Alexis Tsipras, the Greek prime minister, offered him another ministry shortly after he was relieved as finance minister.

We’ve had a listen to the entire call, and transcribed most of it – excluding some inconsequential asides to the teleconference’s hosts, Messrs Marsh and Norman Lamont, the former UK finance minister.

The recording starts with an apparent interruption of the speakers; the teleconference operator announces that the call is now being recorded. Then Varoufakis begins:

The thing is, I have to admit we did not have a mandate for bringing Greece out of the euro. What we had a mandate to do was to negotiate for a kind of arrangement with the eurogroup, with the European Central Bank that would render Greece sustainable within the eurozone.

The mandate went a bit further, at least in my estimation. I think the Greek people had authorised us to peruse energetically and vigorously that negotiation to the point of saying that if we can’t have a viable agreement, then we should consider getting out.

The problem was that, once you are inside the grasps of a monetary union, it is ever so hard to create the kind of public dialogue which is necessary in order to prepare people for what comes, for the process of disengagement from the currency union, while at the same time not precipitating a collapse.

It’s a little bit like, imagine if you had to prepare a population, an electorate, for a devaluation, a very large devaluation, 12 months before it takes place, through a dialogue. You can understand that this is an impossibility. We don’t have a currency which we can devalue vis-à-vis the euro. We have the euro. What I keep telling people is that, in our estimation, it would have taken 12 months.

Varoufakis is then interrupted by Marsh, who suggests the Greek government was weakened by not having a viable Grexit plan in place during negotiations with its creditors and asks whether Varoufakis believes Grexit is still possible.

Oh absolutely, absolutely, I think this agreement is not viable and Dr Wolfgang Schäuble, the German finance minister, is hell-bent on effecting a Grexit, so nothing is over.

But let me be very specific and very precise on this. The prime minister, before he became prime minister, before we won the election in January, had given me the green light to come up with a Plan B. I assembled a very able team, a small team, as it had to be, because that had to be kept completely under wraps, for obvious reasons. And we’ve been working since the end of December, beginning of January, on creating one.

Let me give you, if you are interested, some of the political and institutional impediments that made it hard for us to complete the work, and indeed to activate it. The work was more or less complete, we did have a Plan B, but the difficulty was to go from the five people who were planning it to the 1,000 people that would have to implement it. For that, I had to receive another authorisation, which never came.

Then Varoufakis goes into the main revelations that everyone has focused on: his efforts to create a parallel payment system by hacking into the country’s tax system.

Let me give you an example. We were planning along a number of fronts, I’ll just mention one. Take the case of the first few moments when the banks are shut, the ATMs stop functioning and there has to be some parallel payment system by which we keep the economy going for a little while to give the population the feel that the state is in control and that there is a plan.

What we planned to do is the following. There is the website of the tax office, like there is in Britain and everywhere else, where citizens, taxpayers go into the website, they use their tax file number, and they transfer through web banking monies from the bank account to their tax file number so as to make payments on VAT, on income tax, and so on and so forth.

We were planning to create, surreptitiously, reserve accounts attached to every tax file number without telling anyone. Just to have this system function under wraps and at the touch of a button to allow us to give PIN numbers to tax file number holders, taxpayers, so when, let’s say – take for instance the case where the state owes €1m to some pharmaceutical company for drugs purchased on behalf of the National Health Service. We could immediately create a digital transfer into that reserve account of the tax file number of the pharmaceutical company and provide them with the PIN number so that they could use this as a kind of parallel payment mechanism by which to transfer whichever part of those digital monies they wanted to any tax file number to whom they owed money, or indeed to use it in order to make tax payments to the state.

That would have created a parallel banking system while the banks were shut as a result of the ECB’s aggressive action, to give us some breathing space. This was very well developed and I think it would have made a very big difference, because very soon we could have extended it using apps on smart phones. It would become a functioning and functional parallel system. Then of course this would be euro denominated, but at a drop of a hat, it could be converted to a new drachma.

Now let me tell you, and I thank this is a quite fascinating story, what difficulties I faced. The general secretariat of public revenues, within my ministry, is controlled fully and directly by the troika. It was not under control of my ministry, of [unclear] ministry, it was controlled by Brussels. The general secretary is appointed, effectively, through a process that troika-controlled and the whole mechanism within. It’s like Inland Revenue in the United Kingdom being controlled by Brussels. I am sure as you’re hearing these words, your hair is standing up. Ok. So problem number one.

The general secretariat of information systems, on the other hand, was controlled by me as minister. I appointed a good friend of mine, a childhood friend of mine, who had become a professor of IT at Columbia University in the States, and so on, I put him there because I trusted him to develop the system. At some point, a week or so after we moved into the ministry, he calls me up and says to me: “You know what, I control the machines, I control the hardware. I don’t control the software.” The software belongs to the troika-controlled general secretariat for public revenues.

What do we do? So we had a meeting, just the two of us, nobody else knew. He said: “Listen, if I ask for permission from them to start implementing this programme then the troika will immediately know we are designing a parallel system.” Well, I said, “That won’t do, we don’t want to reveal our hand at this stage.” So I authorised him, and you can’t tell anyone that, this is totally between us, to hack…

At this point, Lamont interrupts Varoufakis to remind him there are others on the call, adding “they will not tell it to their friends.” Varoufakis chuckles:

I know, I know, I know they are. Even if they do, I’ll refute, I’ll deny I said it.

So, we decided to hack into my minister’s own software programme in order to be able to bring it all, to just copy, just copy the codes of the tax systems’ website onto a large computer in his office, so he can work out how to design and implement this parallel payment system. We were ready to get the green light from the prime minister when the banks closed in order to move into the general secretariat of public revenues, which was not controlled by us but is controlled by Brussels, and to plug this laptop in and to energise the system.

I’m trying to convey to you the kind of institutional problems that we had, and institutional impediments to carrying out an independent policy for ameliorating the affects of having our banks being closed down by the ECB.

Lamont then interrupts Varoufakis, calling the revelations “truly shocking”, adding “I won’t ever forget that”. He then asks whether Varoufakis thinks debt relief will ever be granted as part of the new bailout programme.

My great worry at the moment on behalf of my good friend Euclid Tsakalotos…is that the IMF and Dr Schäuble and the ESM are engaged in a game that is absolutely the opposite of straight forward. On the one hand, we’re being told the ESM will only provide this must-discussed loan of more than €80bn if the IMF is on board. The IMF is coming out with debt sustainability analyses which quite clearly, stated for direct quotes, that the Greek debt is not sustainable and according to its own rules the IMF cannot participate in any new bailout. I mean, they’ve already violated their rules twice to do so, but I don’t think they will do it a third time. I think they are kicking and screaming that they are not going to do it a third time.

So there is a very serious danger here that the Greek parliament – not in my name, but in the name of the majority who voted last night – will approve the very stringent measures, reforms they call them but they are nothing but cost-cutting exercises without much reforming going on. But anyway, that we will push through parliament these prior actions, as they’re being called, but then at the end of the day, the ESM and the IMF will not be able to coordinate so as to provide that huge loan. Not that I want that huge loan to be provided…but I think there is a major battle between the institutions, the ESM, the European Commission, the IMF and Dr Schäuble.

Dr Schäuble and the IMF have a common interest: they don’t want this deal to go ahead. Wolfgang has quite clearly said to me he wants Grexit. He thinks this extended attempt is unacceptable. This is the one point where we see eye to eye. I agree with him, too, for completely different reasons, of course. The IMF does not want an agreement because it does not want to have to violate its charter again and to provide new loans to a country whose debt is not viable. The Commission really wants this deal to go ahead, Merkel wants this deal to go ahead. So what has been happening over the last five months is now projected into the very short term, only it is on steroids – that is this complete lack of coordination between the creditors.

Marsh then takes the floor to ask about France, noting that Varoufakis has in the past argued that Berlin is being overly tough with Greece in order to send signals to Paris.

The French are terrified. They’re terrified because they know if they’re going to shrink their budget deficit to the levels that Berlin demands the Parisian government will certainly fall. There is no way that they can politically handle the kinds of austerity which is demanded of them by Berlin. And when I say by Berlin, I mean by Berlin, I don’t mean Brussels. I mean Berlin.

So they are trying to buy time. This is what they’ve been doing now, as you know, for a couple of years. They’ve been trying to buy time in terms of an extension of the time period during which they will have to reduce their deficit to below 3.5 per cent, 3 per cent, the Maastricht criteria in the Stability and Growth Pact.

At the very same time, Wolfgang Schäuble has a plan…. This is one of the very sweet moments in one’s life when one does not have to theorise, because all I did was to convey the plan as Dr Schäuble described it to me. The way he described it to me is very simple. He believes the eurozone is not sustainable as it is. He believes there has to be some fiscal transfers, some degree of political union. He believes for that political union to work without federation, without the legitimacy that a properly-elected federal parliament can render, can bestow upon an executive, it will have to be done in a very disciplinarian way. He said explicitly to me that a Grexit, a Greek exit, is going to equip him with sufficient bargaining power, with sufficient terrorising power in order to impose upon the French that which Paris is resisting. What is that? A degree of transfer of budget-making powers from Paris to Brussels.

Lamont then asks about the ECB. He notes that there has been a lot of vitriol aimed at ECB president Mario Draghi from Athens, accusing him of acting politically during the crisis. But Lamont argues Draghi has “bent over backwards” not to be political during the Greek standoff.

Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European Central Bank is set up in such a way that it is so highly political, it is impossible not to be political.

Don’t forget the ECB, the central bank of Greece – because that’s what the ECB is, it’s the central bank of all our member states – the central bank of Greece is a creditor of the Greek state, and therefore it is also [break in audio] once it is the lender of last resort, supposedly, and the enforcer of fiscal austerity. Now, that violates, immediately, the supposed distinction between fiscal and monetary policy. It puts Draghi in a position where, in acting as a creditor when we came into power, he had to discipline us, he had to actually asphyxiate us sufficiently in order to yield to the demands of the creditors, while at the same time keeping our banks open. So God could not do this in a non-political way.

Then Marsh asks a final two-part question: first, is it important that Greece finally become part of the ECB’s bond-buying programme, known as quantitative easing (QE), and secondly, what are Varoufakis’ future plans – and what is his relationship with Tsipras like now? For those not following the crisis closely, Greece has been shut out of the ECB’s QE programme since its inception because its rules bar any country that is undergoing a bailout review from having its bonds purchased by Frankfurt.

What the ECB is doing is increasing ELA by €900m in order to give a little bit more liquidity through the ATMs that were very severely circumscribed up until now. The question of quantitative easing is I think crucial. If Greece does not get onto the bandwagon of quantitative easing over the next few months, then that’s it. There’s absolutely no way that Greece can stay in the eurozone.

But for this to be meaningful, first they need to restructure the Greek debt. The idea of the German government, that we would first have to successfully complete a programme that cannot be completed successfully and then we can have debt restructuring, effectively annuls the whole idea of quantitative easing.

On the question of my relationship with Alexis, look, I have a very strong personal relationship with him…. Yesterday, I voted against him. I crossed the floor. It was very painful for me. I could see he was very upset by that. We met afterwards, he was sitting down, I was passing by him, he extended his arm very warmly. I sort of went towards him and we hugged, and kissed even. There is this.

But at the same time, at the moment what I’m experiencing is this, you know, I’ve become the traitor of the party. You know how it feels when you cross the floor suddenly. You cross the floor not because you shifted, but because everybody else has shifted. They’ve undergone a mutation. Suddenly they have adopted the language that I’ve been countering for the last six years – with them. But now they have adopted it.

So I’m not sure what kind of relationship we’re going to have. Up until yesterday Alexis was very keen to say to me that he will definitely need me. He offered me another ministry only a few days ago. I said no because I don’t care about having a ministry. What I care about is a sustainable Greek debt, a sustainable Greek economy.

What we’re doing now, whatever the reasons are, the measures we introduced yesterday through parliament will choke the Greek private sector, a private sector that has already suffered so much in Greece over the last five years. I’m going to stay in parliament. I really love being a backbencher. I have only been a backbencher for a week, and it’s great. It gives me the opportunity to speak out, and to write and to visit friends outside of Greece.

Marsh wraps up the teleconference by noting there were 84 callers from around the world, and reminding everyone Varoufakis’ remarks were under the so-called Chatham House rules, which means the information can be passed on but Varoufakis should not be cited as the source of the information.

The London-based Official Monetary and Financial Institutions Forum, headed by two ex-Financial Times scribes – chairman John Plender and managing director David Marsh – on Monday released a 24-minute audiotape of a teleconference they held nearly two weeks ago with Yanis Varoufakis, the former Greek finance minister.

Details of the call were first revealed by the Greek daily Kathimerini, and much of most sensational revelations Varoufakis made were about a surreptitious project he and a small team of aides worked on to set up a parallel payments system that could be activated if the European Central Bank forced the shutdown of the Greek financial system.

But Varoufakis also made some other interesting allegations, including claims the International Monetary Fund believes the Greek bailout is doomed and that Alexis Tsipras, the Greek prime minister, offered him another ministry shortly after he was relieved as finance minister.

We’ve had a listen to the entire call, and transcribed most of it – excluding some inconsequential asides to the teleconference’s hosts, Messrs Marsh and Norman Lamont, the former UK finance minister.

The recording starts with an apparent interruption of the speakers; the teleconference operator announces that the call is now being recorded. Then Varoufakis begins:

The thing is, I have to admit we did not have a mandate for bringing Greece out of the euro. What we had a mandate to do was to negotiate for a kind of arrangement with the eurogroup, with the European Central Bank that would render Greece sustainable within the eurozone.

The mandate went a bit further, at least in my estimation. I think the Greek people had authorised us to peruse energetically and vigorously that negotiation to the point of saying that if we can’t have a viable agreement, then we should consider getting out.

The problem was that, once you are inside the grasps of a monetary union, it is ever so hard to create the kind of public dialogue which is necessary in order to prepare people for what comes, for the process of disengagement from the currency union, while at the same time not precipitating a collapse.

It’s a little bit like, imagine if you had to prepare a population, an electorate, for a devaluation, a very large devaluation, 12 months before it takes place, through a dialogue. You can understand that this is an impossibility. We don’t have a currency which we can devalue vis-à-vis the euro. We have the euro. What I keep telling people is that, in our estimation, it would have taken 12 months.

Varoufakis is then interrupted by Marsh, who suggests the Greek government was weakened by not having a viable Grexit plan in place during negotiations with its creditors and asks whether Varoufakis believes Grexit is still possible.

Oh absolutely, absolutely, I think this agreement is not viable and Dr Wolfgang Schäuble, the German finance minister, is hell-bent on effecting a Grexit, so nothing is over.

But let me be very specific and very precise on this. The prime minister, before he became prime minister, before we won the election in January, had given me the green light to come up with a Plan B. I assembled a very able team, a small team, as it had to be, because that had to be kept completely under wraps, for obvious reasons. And we’ve been working since the end of December, beginning of January, on creating one.

Let me give you, if you are interested, some of the political and institutional impediments that made it hard for us to complete the work, and indeed to activate it. The work was more or less complete, we did have a Plan B, but the difficulty was to go from the five people who were planning it to the 1,000 people that would have to implement it. For that, I had to receive another authorisation, which never came.

Then Varoufakis goes into the main revelations that everyone has focused on: his efforts to create a parallel payment system by hacking into the country’s tax system.

Let me give you an example. We were planning along a number of fronts, I’ll just mention one. Take the case of the first few moments when the banks are shut, the ATMs stop functioning and there has to be some parallel payment system by which we keep the economy going for a little while to give the population the feel that the state is in control and that there is a plan.

What we planned to do is the following. There is the website of the tax office, like there is in Britain and everywhere else, where citizens, taxpayers go into the website, they use their tax file number, and they transfer through web banking monies from the bank account to their tax file number so as to make payments on VAT, on income tax, and so on and so forth.

We were planning to create, surreptitiously, reserve accounts attached to every tax file number without telling anyone. Just to have this system function under wraps and at the touch of a button to allow us to give PIN numbers to tax file number holders, taxpayers, so when, let’s say – take for instance the case where the state owes €1m to some pharmaceutical company for drugs purchased on behalf of the National Health Service. We could immediately create a digital transfer into that reserve account of the tax file number of the pharmaceutical company and provide them with the PIN number so that they could use this as a kind of parallel payment mechanism by which to transfer whichever part of those digital monies they wanted to any tax file number to whom they owed money, or indeed to use it in order to make tax payments to the state.

That would have created a parallel banking system while the banks were shut as a result of the ECB’s aggressive action, to give us some breathing space. This was very well developed and I think it would have made a very big difference, because very soon we could have extended it using apps on smart phones. It would become a functioning and functional parallel system. Then of course this would be euro denominated, but at a drop of a hat, it could be converted to a new drachma.

Now let me tell you, and I thank this is a quite fascinating story, what difficulties I faced. The general secretariat of public revenues, within my ministry, is controlled fully and directly by the troika. It was not under control of my ministry, of [unclear] ministry, it was controlled by Brussels. The general secretary is appointed, effectively, through a process that troika-controlled and the whole mechanism within. It’s like Inland Revenue in the United Kingdom being controlled by Brussels. I am sure as you’re hearing these words, your hair is standing up. Ok. So problem number one.

The general secretariat of information systems, on the other hand, was controlled by me as minister. I appointed a good friend of mine, a childhood friend of mine, who had become a professor of IT at Columbia University in the States, and so on, I put him there because I trusted him to develop the system. At some point, a week or so after we moved into the ministry, he calls me up and says to me: “You know what, I control the machines, I control the hardware. I don’t control the software.” The software belongs to the troika-controlled general secretariat for public revenues.

What do we do? So we had a meeting, just the two of us, nobody else knew. He said: “Listen, if I ask for permission from them to start implementing this programme then the troika will immediately know we are designing a parallel system.” Well, I said, “That won’t do, we don’t want to reveal our hand at this stage.” So I authorised him, and you can’t tell anyone that, this is totally between us, to hack…

At this point, Lamont interrupts Varoufakis to remind him there are others on the call, adding “they will not tell it to their friends.” Varoufakis chuckles:

I know, I know, I know they are. Even if they do, I’ll refute, I’ll deny I said it.

So, we decided to hack into my minister’s own software programme in order to be able to bring it all, to just copy, just copy the codes of the tax systems’ website onto a large computer in his office, so he can work out how to design and implement this parallel payment system. We were ready to get the green light from the prime minister when the banks closed in order to move into the general secretariat of public revenues, which was not controlled by us but is controlled by Brussels, and to plug this laptop in and to energise the system.

I’m trying to convey to you the kind of institutional problems that we had, and institutional impediments to carrying out an independent policy for ameliorating the affects of having our banks being closed down by the ECB.

Lamont then interrupts Varoufakis, calling the revelations “truly shocking”, adding “I won’t ever forget that”. He then asks whether Varoufakis thinks debt relief will ever be granted as part of the new bailout programme.

My great worry at the moment on behalf of my good friend Euclid Tsakalotos…is that the IMF and Dr Schäuble and the ESM are engaged in a game that is absolutely the opposite of straight forward. On the one hand, we’re being told the ESM will only provide this must-discussed loan of more than €80bn if the IMF is on board. The IMF is coming out with debt sustainability analyses which quite clearly, stated for direct quotes, that the Greek debt is not sustainable and according to its own rules the IMF cannot participate in any new bailout. I mean, they’ve already violated their rules twice to do so, but I don’t think they will do it a third time. I think they are kicking and screaming that they are not going to do it a third time.

So there is a very serious danger here that the Greek parliament – not in my name, but in the name of the majority who voted last night – will approve the very stringent measures, reforms they call them but they are nothing but cost-cutting exercises without much reforming going on. But anyway, that we will push through parliament these prior actions, as they’re being called, but then at the end of the day, the ESM and the IMF will not be able to coordinate so as to provide that huge loan. Not that I want that huge loan to be provided…but I think there is a major battle between the institutions, the ESM, the European Commission, the IMF and Dr Schäuble.

Dr Schäuble and the IMF have a common interest: they don’t want this deal to go ahead. Wolfgang has quite clearly said to me he wants Grexit. He thinks this extended attempt is unacceptable. This is the one point where we see eye to eye. I agree with him, too, for completely different reasons, of course. The IMF does not want an agreement because it does not want to have to violate its charter again and to provide new loans to a country whose debt is not viable. The Commission really wants this deal to go ahead, Merkel wants this deal to go ahead. So what has been happening over the last five months is now projected into the very short term, only it is on steroids – that is this complete lack of coordination between the creditors.

Marsh then takes the floor to ask about France, noting that Varoufakis has in the past argued that Berlin is being overly tough with Greece in order to send signals to Paris.

The French are terrified. They’re terrified because they know if they’re going to shrink their budget deficit to the levels that Berlin demands the Parisian government will certainly fall. There is no way that they can politically handle the kinds of austerity which is demanded of them by Berlin. And when I say by Berlin, I mean by Berlin, I don’t mean Brussels. I mean Berlin.

So they are trying to buy time. This is what they’ve been doing now, as you know, for a couple of years. They’ve been trying to buy time in terms of an extension of the time period during which they will have to reduce their deficit to below 3.5 per cent, 3 per cent, the Maastricht criteria in the Stability and Growth Pact.

At the very same time, Wolfgang Schäuble has a plan…. This is one of the very sweet moments in one’s life when one does not have to theorise, because all I did was to convey the plan as Dr Schäuble described it to me. The way he described it to me is very simple. He believes the eurozone is not sustainable as it is. He believes there has to be some fiscal transfers, some degree of political union. He believes for that political union to work without federation, without the legitimacy that a properly-elected federal parliament can render, can bestow upon an executive, it will have to be done in a very disciplinarian way. He said explicitly to me that a Grexit, a Greek exit, is going to equip him with sufficient bargaining power, with sufficient terrorising power in order to impose upon the French that which Paris is resisting. What is that? A degree of transfer of budget-making powers from Paris to Brussels.

Lamont then asks about the ECB. He notes that there has been a lot of vitriol aimed at ECB president Mario Draghi from Athens, accusing him of acting politically during the crisis. But Lamont argues Draghi has “bent over backwards” not to be political during the Greek standoff.

Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European Central Bank is set up in such a way that it is so highly political, it is impossible not to be political.

Don’t forget the ECB, the central bank of Greece – because that’s what the ECB is, it’s the central bank of all our member states – the central bank of Greece is a creditor of the Greek state, and therefore it is also [break in audio] once it is the lender of last resort, supposedly, and the enforcer of fiscal austerity. Now, that violates, immediately, the supposed distinction between fiscal and monetary policy. It puts Draghi in a position where, in acting as a creditor when we came into power, he had to discipline us, he had to actually asphyxiate us sufficiently in order to yield to the demands of the creditors, while at the same time keeping our banks open. So God could not do this in a non-political way.

Then Marsh asks a final two-part question: first, is it important that Greece finally become part of the ECB’s bond-buying programme, known as quantitative easing (QE), and secondly, what are Varoufakis’ future plans – and what is his relationship with Tsipras like now? For those not following the crisis closely, Greece has been shut out of the ECB’s QE programme since its inception because its rules bar any country that is undergoing a bailout review from having its bonds purchased by Frankfurt.

What the ECB is doing is increasing ELA by €900m in order to give a little bit more liquidity through the ATMs that were very severely circumscribed up until now. The question of quantitative easing is I think crucial. If Greece does not get onto the bandwagon of quantitative easing over the next few months, then that’s it. There’s absolutely no way that Greece can stay in the eurozone.

But for this to be meaningful, first they need to restructure the Greek debt. The idea of the German government, that we would first have to successfully complete a programme that cannot be completed successfully and then we can have debt restructuring, effectively annuls the whole idea of quantitative easing.

On the question of my relationship with Alexis, look, I have a very strong personal relationship with him…. Yesterday, I voted against him. I crossed the floor. It was very painful for me. I could see he was very upset by that. We met afterwards, he was sitting down, I was passing by him, he extended his arm very warmly. I sort of went towards him and we hugged, and kissed even. There is this.

But at the same time, at the moment what I’m experiencing is this, you know, I’ve become the traitor of the party. You know how it feels when you cross the floor suddenly. You cross the floor not because you shifted, but because everybody else has shifted. They’ve undergone a mutation. Suddenly they have adopted the language that I’ve been countering for the last six years – with them. But now they have adopted it.

So I’m not sure what kind of relationship we’re going to have. Up until yesterday Alexis was very keen to say to me that he will definitely need me. He offered me another ministry only a few days ago. I said no because I don’t care about having a ministry. What I care about is a sustainable Greek debt, a sustainable Greek economy.

What we’re doing now, whatever the reasons are, the measures we introduced yesterday through parliament will choke the Greek private sector, a private sector that has already suffered so much in Greece over the last five years. I’m going to stay in parliament. I really love being a backbencher. I have only been a backbencher for a week, and it’s great. It gives me the opportunity to speak out, and to write and to visit friends outside of Greece.

Marsh wraps up the teleconference by noting there were 84 callers from around the world, and reminding everyone Varoufakis’ remarks were under the so-called Chatham House rules, which means the information can be passed on but Varoufakis should not be cited as the source of the information.

As pessoas são tão ingénuas e tão agarradas aos seus interesses imediatos que um vigarista hábil consegue sempre que um grande número delas se deixe enganar.

Niccolò Machiavelli

http://www.facebook.com/atomez

Niccolò Machiavelli

http://www.facebook.com/atomez

Re: Crise Grega

Estes tipos estavam completamente loucos! Do ponto de vista deles claro que não, estavam apenas a fazer o que fosse preciso fazer para "salvar o país, os cidadãos e manter a economia a funcionar"

Mas ele não perceberia que, mesmo que conseguissem criar um sistema bancário paralelo com base nas contas dos cidadãos no fisco grego (tal como cá temos o Portal das Finanças da AT), o que até seria possível, mal pusessem euros a circular sem a autorização do BCE eles seria imediatamente considerados falsos, contrafeitos e portanto ilegais e sem qualquer valor? Mais ainda, arriscavam a que quem os usasse viesse a ser acusado de falsificação e tráfico de moeda falsa!

Ou então punham dracmas virtuais em circulação e com isso ficavam automaticamente postos fora da zona euro.

Mas há gente como esta que acham que como "estão a trabalhar para o superior bem do povo" podem fazer tudo o que quiserem e as leis em vigor não se lhes aplicam... e nem é preciso ser nada radical para pensar o mesmo... há por cá muitos exemplos, infelizmente.

Mas ele não perceberia que, mesmo que conseguissem criar um sistema bancário paralelo com base nas contas dos cidadãos no fisco grego (tal como cá temos o Portal das Finanças da AT), o que até seria possível, mal pusessem euros a circular sem a autorização do BCE eles seria imediatamente considerados falsos, contrafeitos e portanto ilegais e sem qualquer valor? Mais ainda, arriscavam a que quem os usasse viesse a ser acusado de falsificação e tráfico de moeda falsa!

Ou então punham dracmas virtuais em circulação e com isso ficavam automaticamente postos fora da zona euro.

Mas há gente como esta que acham que como "estão a trabalhar para o superior bem do povo" podem fazer tudo o que quiserem e as leis em vigor não se lhes aplicam... e nem é preciso ser nada radical para pensar o mesmo... há por cá muitos exemplos, infelizmente.

Financial Times Escreveu:Yanis Varoufakis defends ‘Plan B’ tax hack

Yanis Varoufakis has insisted he did nothing improper as part of a five-month clandestine project he ran as Greek finance minister that prepared for his country’s possible exit from the euro.

The scheme, which was almost completed but not fully implemented, involved hacking into Greece’s independent tax service to set up a parallel payment system — accessing individuals’ private identification numbers and copying them on to a computer controlled by a “childhood friend” of Mr Varoufakis.

It would have allowed transactions to continue in case of a prolonged bank holiday and the imposition of capital controls.

Mr Varoufakis described the project in a 25-minute teleconference with private investors on July 16.

A tape of the call was released on Monday by the London-based Official Monetary and Financial Institutions Forum, which hosted the session, after portions were published at the weekend by the Greek newspaper Kathimerini.

“We decided to hack into my minister’s own software programme in order to be able to bring it all, to just copy, just copy the codes of the tax systems’ website on to a large computer in his office, so he can work out how to design and implement this parallel payment system,” Mr Varoufakis said on the call.

“We were ready to get the green light from the prime minister when the banks closed in order to move into the general secretariat of public revenues, which was not controlled by us but is controlled by Brussels, and to plug this laptop in and to energise the system.”

Political opponents expressed outrage at the plan. Greek media reported that 24 MPs from New Democracy, the largest opposition party, had asked Alexis Tsipras, prime minister, whether Mr Varoufakis should face a judicial inquiry.

In a statement, Mr Varoufakis’s office said the project was conducted by a working group he was authorised to establish in order to prepare contingency plans in case Greece was forced out of the eurozone by creditors. The working group broke no laws, the statement said.

“The ministry of finance’s working group worked exclusively within the framework of government policy and its recommendations were always aimed at serving the public interest, at respecting the laws of the land, and at keeping the country in the eurozone,” said Mr Varoufakis’s office.

The disclosures about Mr Varoufakis’s “Plan B” come on the heels of revelations by the Financial Times and other media organisations that far-left members of the governing Syriza party were contemplating a far more radical plan to seize government reserves and take over the country’s central bank in a transition to a new currency.

James K Galbraith, the University of Texas economist and a longtime Varoufakis associate who worked on the finance ministry plan, issued his own statement saying their efforts never overlapped with the more radical efforts other than an “inconclusive” phone call he had with an MP from the Left Platform.

“We had no co-ordination with the Left Platform and our working group’s ideas had little in common with theirs,” said Mr Galbraith.

In his taped remarks, Mr Varoufakis said Mr Tsipras authorised him to prepare for a possible “Grexit”, even before Syriza won January’s parliamentary elections.

“I assembled a very able team, a small team, as it had to be, because that had to be kept completely under wraps, for obvious reasons,” said Mr Varoufakis.

“The difficulty was going from the five people who planned it to the 1,000 that would be implementing it. For that, I had to receive another authorisation that never came.”

The revelations were shrugged off by government officials, who said Mr Tsipras never gave Mr Varoufakis the go-ahead to activate his plan.

“I can’t imagine this [happened],” said Dimitris Mardas, the deputy finance minister in charge of revenues. “But what a government minister’s team proposes doesn’t constitute government policy.”

Mr Tsipras is known to have grown wary of some of Mr Varoufakis’s ideas, a concern that contributed to his decision to replace the outspoken finance minister with Euclid Tsakalotos, a more low-key loyalist, earlier this month.

Mr Varoufakis’s Plan B involved creating reserve accounts “surreptitiously” attached to every taxpayer’s ID that could be used to make payments to other taxpayers when the European Central Bank forced the shutdown of Greece’s banking system, as it did last month.

“That would have created a parallel banking system while the banks were shut as a result of the ECB’s aggressive action, to give us some breathing space,” said Mr Varoufakis.

He insisted the hacking became necessary because the general secretariat of public revenues in Greece was under the control of the creditor institutions.

“The general secretariat of public revenues, within my ministry, is controlled fully and directly by the troika [creditors]. It was not under control of my ministry. . . It was controlled by Brussels,” he said.

The independent revenue office (IRO) was set up as part of Greece’s second bailout in an attempt to eliminate political interference that had helped vested interest groups with close connections to government to avoid meeting their tax obligations.

One person with knowledge of the government computer systems said it would “probably have been possible to hack into the IRO computer, but it would have destroyed the credibility of the revenue office and its mission”.

As pessoas são tão ingénuas e tão agarradas aos seus interesses imediatos que um vigarista hábil consegue sempre que um grande número delas se deixe enganar.

Niccolò Machiavelli

http://www.facebook.com/atomez

Niccolò Machiavelli

http://www.facebook.com/atomez

What Greece gives, China takes away.*

Europe's main equity indices are still holding onto gains for July generated after the prospect of a messy Greek exit from the euro faded.

But advances for Germany's Dax, France's CAC 40 and Italy's FTSE MIB are being chipped away at on Monday as the second largest one-day drop on record for the Shanghai Composite index casts a global shadow over equity markets.

European equities began 2015 as a favourite pick for strategists and, with the eurozone economy slowly improving and the European Central Bank adding stimulus, remain so according to a host of banks including Goldman Sachs and Morgan Stanley.

Analysts at Barclays put Monday's drop down to the unsettling decline in Chinese stocks.

In mid-afternoon trading in Europe:

•The Dax is down 2 per cent though is still up 1.6 per cent for July

•France's CAC 40 is also off 2 per cent but hanging onto a 1.5 per cent increase for the month

•Italy's FTSE MIB is 1.9 per cent weaker but still up 2.6 per cent in July.

in: http://www.ft.com/intl/fastft?q=location:Europe

*Não sei se confio no título deste post. Amanhã, se a bolsa grega abrir, veremos o que ocorre com os títulos mais significativos da banca grega. Por mim, adivinho forte bernarda. Se me enganar não será a primeira vez...

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

O Varoufakis tem feito um alarde enorme sobre as suas movimentações para a implementação de um Plano B no caso de as negociações com os credores falharam. Essas negociações, como sabemos, falharam redondamente e a falta de confiança entre os negociadores não facilitaram a vida aos cidadãos gregos que se veem na contingência de um resgate ainda mais exigente. Para isso contribuiu um referendo inconsequente, as dicas e o comportamento do governo do Syriza e a crescente aversão das opiniões públicas dos países do € a negociações e a concessões aos gregos.

Ora, como se não bastasse, numa altura em que se procuram provas de confiança do lado grego para um aliviar das condições de resgate, o Varoufakis lembra-se de difundir os seus, por assim dizer, preparativos secretos e o Tspras fala em eleições já para outubro.

http://www.theguardian.com/business/liv ... 4173661b03

http://www.ft.com/fastft/366071

http://yanisvaroufakis.eu/2015/07/27/st ... nt-system/

Ora, como se não bastasse, numa altura em que se procuram provas de confiança do lado grego para um aliviar das condições de resgate, o Varoufakis lembra-se de difundir os seus, por assim dizer, preparativos secretos e o Tspras fala em eleições já para outubro.

http://www.theguardian.com/business/liv ... 4173661b03

http://www.ft.com/fastft/366071

http://yanisvaroufakis.eu/2015/07/27/st ... nt-system/

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

A Grécia na Reuters

Duas notícias: Uma sobre os riscos bancários que a Grécia vai assumir. (Se pensarmos que os 4 maiores bancos gregos podem estar aflitos e se soubermos que são 'sistémicos' - como, de facto, se diz por aí- então até pode acontecer que não seja só a Grécia a estar enrascada...). Outra, sobre as reestruturações que a zona € vai ter de fazer. Seja pela titubeante mão gaulesa, ou pela empertigada batuta germânica.

Esta: http://www.reuters.com/article/2015/07/ ... 5P20150726

e esta: http://www.reuters.com/article/2015/07/ ... E720150725

Esta: http://www.reuters.com/article/2015/07/ ... 5P20150726

e esta: http://www.reuters.com/article/2015/07/ ... E720150725

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

Nos últimos dias já não sei se o Varoufakis faz agit/prop de acordo com o Tsipras, se a faz de acordo consigo e com a sua consciência, ou se quer mesmo tramar o Tsirpas...

Sei que o Varoufakis gosta de 'aparecer'. Isso é evidente.

Como se não bastasse, desde há uns dias a esta parte, este rumor que li no FT pela mão do Atomez, tem tomado dimensão, tem sofrido cortes e tem somado acrescentos e já vai sendo uma daquelas notícias incontornáveis:

http://www.theguardian.com/world/2015/jul/26/greece-yanis-varoufakis-secret-plan-raid-banks-drachma-return

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

A Bolsa de Atenas não reabre amanhã.

A Bolsa de Atenas não reabre amanhã. É possível que reabra na Terça. Também é possível que não reabra na Terça... Seja como for, estou muito curioso com esta eventual reabertura.

http://www.ekathimerini.com/199948/article/ekathimerini/business/athens-bourse-to-stay-shut-on-monday-might-open-on-tuesday

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

Cherchez la femme...

Desamor no Olimpo: como a riquíssima Sra. Varoufakis irrita a discreta Sra. Tsipras

Desamor no Olimpo: como a riquíssima Sra. Varoufakis irrita a discreta Sra. Tsipras

As pessoas são tão ingénuas e tão agarradas aos seus interesses imediatos que um vigarista hábil consegue sempre que um grande número delas se deixe enganar.

Niccolò Machiavelli

http://www.facebook.com/atomez

Niccolò Machiavelli

http://www.facebook.com/atomez

Re: Crise Grega

Convocar referendos é muito democrático, mas respeitar a vontade neles expressa ainda é mais!

A Grécia no Le Monde

A carta da humilhação. Os gregos não tiveram apenas de tolerar a presença do FMI: foram cruelmente coagidos a solicitá-la por escrito.

In: http://www.lemonde.fr/crise-de-l-euro/a ... ece&xtcr=7

Ler ainda: http://www.lemonde.fr/economie/article/ ... ece&xtcr=6

O monopólio governamental sobre a energia elétrica, impensável há uns meses, tembém está ameaçado: http://www.lemonde.fr/europe/article/20 ... ece&xtcr=2

Entretanto a reforma da Europa titubeia...: http://www.lemonde.fr/europe/article/20 ... ece&xtcr=3

In: http://www.lemonde.fr/crise-de-l-euro/a ... ece&xtcr=7

Ler ainda: http://www.lemonde.fr/economie/article/ ... ece&xtcr=6

O monopólio governamental sobre a energia elétrica, impensável há uns meses, tembém está ameaçado: http://www.lemonde.fr/europe/article/20 ... ece&xtcr=2

Entretanto a reforma da Europa titubeia...: http://www.lemonde.fr/europe/article/20 ... ece&xtcr=3

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

Eu cultivar-me? Deves ir mandar o IGCP cultivar-se. Tão bom é um como o outro

World debt clock:

http://www.usdebtclock.org/world-debt-clock.html

http://www.usdebtclock.org/world-debt-clock.html

- Mensagens: 1278

- Registado: 11/11/2011 3:58

- Localização: 16

Re: Crise Grega

jccgold Escreveu:Para quando a Alemanha a propor a saída "temporária" de Portugal da zona EURO? Após venda de CTT, TAP, EDP, etc.

Dívida portuguesa disparou 36% em 4 anos

http://sicnoticias.sapo.pt/economia/201 ... -em-4-anos

cultiva-te um pouco...

https://campelodemagalhaes.wordpress.co ... -socrates/

- Mensagens: 1331

- Registado: 15/4/2008 14:12

Re: Crise Grega

A "ala esquerda" do Syriza estava em delírio total! Isto seria um golpe de estado comunista...

Financial Times Escreveu:Syriza’s covert plot during crisis talks to return to drachma

Arresting the central bank’s governor. Emptying its vaults. Appealing to Moscow for help.

These were the elements of a covert plan to return Greece to the drachma hatched by members of the Left Platform faction of Greece’s governing Syriza party.

They were discussed at a July 14 meeting at the Oscar Hotel in a shabby downtown district of Athens following an EU summit that saw Greece cave to its creditors, leaving many in the party feeling despondent and desperate.

The plans have come to light through interviews with participants in the meeting as well as senior Greek officials and sympathetic journalists who were waiting outside the gathering and briefed on the talks.

They offer a sense of the chaos and behind-the-scenes manoeuvring as Greece nearly crashed out of the single currency before prime minister Alexis Tsipras agreed to the outlines of an €86bn bailout at the EU summit. With that deal still to be finalised, they are also a reminder of the determination of a sizeable swath of Mr Tsipras’ leftwing party to return the country to the drachma and increase state control of the economy.

Chief among them is Panayotis Lafazanis, the former energy and environment minister and leader of Syriza’s Left Platform, which unites a diverse group of far left activists — from supporters of the late Venezuelan president Hugo Chávez to old-fashioned communists. He was eventually sacked in a cabinet reshuffle after voting against reforms tied to the bailout.

“Obviously it was a moment of high tension,” a Syriza activist said, describing the atmosphere as the meeting opened. “But you were also aware of a real revolutionary spirit in the room.”

Yet even hardline communists were taken aback when Mr Lafazanis proposed that the Syriza government should seize control of the Nomismatokopeion, the Greek mint, where the bulk of the country’s cash reserves are kept.

“Our plan is that we go for a national currency. This is what we should have done already. But we can do it now,” he said, according to people present at the meeting.

Mr Lafazanis said the reserves, which he claimed amounted to €22bn, would pay for pensions and public sector wages and also keep Greece supplied with food and fuel while preparations were made for launching a new drachma.

Meanwhile, the central bank would immediately lose its independence and be placed under government control. Its governor, Yannis Stournaras, would be arrested if, as expected, he opposed the move.

“For people planning a conspiracy to undermine the Greek state, they were pretty open about it,” said one reporter who staked out the event.

The plan demonstrates the apparently ruthless determination of Syriza’s far leftists to pursue their political aims — but also their lack of awareness of the workings of the eurozone financial system.

For one thing, the vaults at the Nomismatokopeion currently hold only about €10bn of cash — enough to keep the country afloat for only a few weeks but not the estimated six to eight months required to prepare, test and launch a new currency.

The Syriza government would have quickly found the country’s stash of banknotes unusable. Nor would they be able to print more €10 and €20 banknotes: From the moment the government took over the mint, the European Central Bank would declare Greek euros as counterfeit, “putting anyone who tried to buy something with them at risk of being arrested for forgery,” said a senior central bank official.

“The consequences would be disastrous. Greece would be isolated from the international financial system with its banks unable to function and its euros worthless,” the official added.

As the details of the Left Platform meeting have leaked out, some political opponents are demanding an accounting.

“Members of this government planned a trip to hell for Greeks,” said Stavros Theodorakis, leader of the pro-EU To Potami party. “They planned to raid the vaults of the people and invade the mint as if it were a Playmobil game. Alexis Tsipras must tell us the truth about what happened.”

Mr Lafazanis did not respond to repeated requests for comment. A spokesman did not deny the plans but called Mr Theodorakis’ reaction “garbage” and dismissed it as typical of the country’s political class.

Mr Lafazanis was not alone in suggesting unorthodox ways in which Greece might adopt a new drachma: Just before Mr Tsipras signed up to the bailout, his former finance minister, Yanis Varoufakis, publicly proposed issuing IOUs to cover all payments until a new currency could be formally issued. He also called for the government to take over control of the central bank.

Even before the Oscar Hotel meeting, Mr Lafazanis, a former Greek Communist Party official, was pursuing desperate schemes to address the government’s financial woes.

Given the communist past of Mr Tsipras and other leading government figures, Athens believed it would be a simple matter to win $5bn to $10bn in financial backing from Vladimir Putin, the Russian president.

Mr Lafazanis visited Moscow three times as Mr Tsipras’s envoy after Syriza came to power in January. In return for signing up to a new gas pipeline project, he hoped for at least €5bn in prepayments of gas transit fees, according to people briefed on the initiative. But the Russians rejected the deal the week before the EU summit.

“It was all a fantasy,” said a senior Greek banker. “The Left Platform’s dreams of free gas and a Russian-backed drachma have crumbled away.”

As pessoas são tão ingénuas e tão agarradas aos seus interesses imediatos que um vigarista hábil consegue sempre que um grande número delas se deixe enganar.

Niccolò Machiavelli

http://www.facebook.com/atomez

Niccolò Machiavelli

http://www.facebook.com/atomez

Crise Grega: notícias soltas

A bolsa de Atenas já fechou há quase um mês. Equaciona-se a sua reabertura na próxima semana.

http://www.reuters.com/article/2015/07/ ... 0B20150723

http://bourse.lesechos.fr/forex/infos-e ... 070260.php

Entretanto teme-se que o exemplo BES alastre na Grécia... mas em tamanho grego, uma coisa em grande.

http://www.reuters.com/article/2015/07/ ... G320150724

http://www.reuters.com/article/2015/07/ ... 0B20150723

http://bourse.lesechos.fr/forex/infos-e ... 070260.php

Entretanto teme-se que o exemplo BES alastre na Grécia... mas em tamanho grego, uma coisa em grande.

http://www.reuters.com/article/2015/07/ ... G320150724

"Se um homem tiver realmente muita fé, pode dar-se ao luxo de ser céptico."

in: Citações e Pensamentos, Friedrich Nietzsche

in: Citações e Pensamentos, Friedrich Nietzsche

Re: Crise Grega

13 perguntas e respostas para perceber a crise da Grécia

http://www.jornaldenegocios.pt/economia/europa/uniao_europeia/zona_euro/detalhe/13_perguntas_e_respostas_para_perceber_a_crise_da_grecia.html

http://www.jornaldenegocios.pt/economia/europa/uniao_europeia/zona_euro/detalhe/13_perguntas_e_respostas_para_perceber_a_crise_da_grecia.html

- Mensagens: 214

- Registado: 29/11/2007 10:06

- Localização: Lourinhã

Re: Crise Grega

Para quando a Alemanha a propor a saída "temporária" de Portugal da zona EURO? Após venda de CTT, TAP, EDP, etc.

Dívida portuguesa disparou 36% em 4 anos

http://sicnoticias.sapo.pt/economia/201 ... -em-4-anos

Dívida portuguesa disparou 36% em 4 anos

http://sicnoticias.sapo.pt/economia/201 ... -em-4-anos

World debt clock:

http://www.usdebtclock.org/world-debt-clock.html

http://www.usdebtclock.org/world-debt-clock.html

- Mensagens: 1278

- Registado: 11/11/2011 3:58

- Localização: 16

Re: Crise Grega

Prá já com dividas impagáveis a Grega e a Portuguesa só resta um caminho, reestruturação da divida e a privatização do País quem sabe até a Nacionalidade ao invés de serem Gregos ou Portugueses serão apenas Europeus em perda de identidade também a cultural e sem pátria. Para uns restas o queijo feta e as Ilhas e para outros vinho tinto e chouriças.

No dia 12 de julho, a cúpula com os líderes da zona euro ditou os seus termos de rendição ao primeiro-ministro grego, Alexis Tsipras, que, aterrorizado com as alternativas, aceitou todos eles. Um desses termos dizia respeito à disposição dos restantes ativos públicos da Grécia.

Os líderes da zona euro exigiram que os ativos públicos gregos sejam transferidos para um fundo do género Treuhand – um veículo de venda urgente semelhante ao utilizado após a queda do Muro de Berlim para privatizar rapidamente, com grande prejuízo financeiro e com efeitos devastadores no emprego de toda a propriedade pública do Estado alemão oriental que desvaneceu.

Este Treuhand grego seria sediado em – esperem por isso – Luxemburgo e seria gerido por uma equipe orientada pelo ministro das Finanças da Alemanha, Wolfgang Schäuble, o autor do esquema. Isso iria concluir as vendas urgentes no espaço de três anos. Mas atendendo a que o trabalho do Treuhand original foi acompanhado por investimentos maciços em infraestruturas por parte da Alemanha Ocidental e por transferências sociais em larga escala para a população da Alemanha Oriental, o povo da Grécia não receberia nenhum benefício correspondente de qualquer espécie.

Euclid Tsakalotos, que me sucedeu como ministro das Finanças da Grécia, há duas semanas, fez o seu melhor para melhorar os piores aspetos do plano grego Treuhand. Ele fez que o fundo ficasse domiciliado em Atenas e arrancou dos credores da Grécia (a chamada troika da Comissão Europeia, do Banco Central Europeu e do Fundo Monetário Internacional) a importante autorização para que as vendas possam continuar ao longo de 30 anos, em vez dos meros três. Isto foi crucial, pois irá permitir ao Estado grego manter os ativos subvalorizados até que o seu preço recupere dos baixos atuais induzidos pela recessão.

Infelizmente, o Treuhand grego continua a ser uma abominação e deveria ser um estigma na consciência da Europa. Pior, é uma oportunidade perdida.

O plano é politicamente tóxico, porque o fundo, embora domiciliado na Grécia, irá efetivamente ser gerido pela troika. É também financeiramente nocivo, porque as receitas irão pagar os juros daquela que até o FMI admite agora ser uma dívida impagável. E falha em nível econômico, porque desperdiça uma oportunidade maravilhosa de criar investimentos de produção nacional para ajudar a combater o impacto recessivo da consolidação fiscal punitiva que também faz parte dos “termos” da cimeira de 12 de julho.

As coisas não têm de ser assim. No dia 19 de junho, comuniquei ao governo alemão e à troika uma proposta alternativa, como parte de um documento intitulado “Acabar com a crise grega”:

“O governo grego propõe agrupar bens públicos (excluindo os pertinentes para a segurança do país, os equipamentos públicos e o património cultural) numa holding central separada da administração do governo e gerida como uma entidade privada, sob a égide do Parlamento grego, com o objetivo de maximizar o valor dos seus ativos subjacentes e criar um fluxo de investimento de produção nacional. O Estado grego será o único acionista, mas não irá garantir os seus passivos ou a sua dívida.”

A holding iria desempenhar um papel dinâmico, preparando os ativos para venda. Iria “emitir uma obrigação plenamente adicional nos mercados de capitais internacionais” para originar 30 a 40 mil milhões de euros (US$ 32 a US$ 43 bilhões), que, “tendo em conta o valor presente dos ativos”, iriam “ser investidos na modernização e reestruturação dos ativos sob a sua administração”.

O plano previa um programa de investimentos de 3-4 anos, resultando numa “despesa adicional de 5% do PIB por ano”, com condições macroeconómicas atuais implicando “um multiplicador de crescimento positivo acima de 1,5″, o que “deveria impulsionar o crescimento nominal do PIB para um nível superior a 5% durante vários anos”. Este, por sua vez, induziria “aumentos proporcionais em receitas fiscais”, dessa forma “contribuindo para a sustentabilidade fiscal, permitindo ao governo grego exercitar uma disciplina nos gastos sem diminuir ainda mais a economia social”.

Neste cenário, o superavit primário (que exclui o pagamento de juros) iria “alcançar magnitudes a uma “velocidade de escape” em absoluto, bem como termos percentuais ao longo do tempo”. Como resultado, à holding iria “ser concedida uma licença bancária” no prazo de um ou dois anos “transformando-se assim num banco de desenvolvimento de pleno direito com capacidade de complementaridade no investimento privado na Grécia e de entrar em projetos de colaboração com o Banco de Investimento Europeu”.

O banco de desenvolvimento que propusemos iria “permitir ao governo escolher que bens seriam, ou não, privatizados, garantindo ao mesmo tempo um maior impacto na redução da dívida a partir das privatizações selecionadas”. Afinal de contas, “os valores dos ativos deveriam aumentar mais do que o montante real gasto na modernização e na reestruturação, auxiliado por um programa de parcerias público-privadas, cujo valor é reforçado de acordo com a probabilidade de futura privatização”.

A nossa proposta foi saudada com um silêncio ensurdecedor. Mais precisamente, o Eurogrupo dos ministros das Finanças da zona euro e a troika continuaram a deixar passar para os meios de comunicação mundiais que as autoridades gregas não tinham propostas inovadoras, credíveis para oferecer – o seu refrão padrão. Alguns dias mais tarde, uma vez que as potências ter-se-ão apercebido de que o governo grego estaria prestes a render-se plenamente às exigências da troika, acharam conveniente impor à Grécia o seu degradante, sem imaginação e pernicioso modelo Treuhand.

Num ponto de virada na história da Europa, a nossa alternativa inovadora foi atirada para o caixote do lixo. Ela permanece lá para outros recuperarem.

Yanis Varoufakis é economista, blogueiro e político grego, membro do partido Syriza. Foi ministro das Finanças do Governo Tsipras.

http://correiodobrasil.com.br/europa-te ... =b20150723

No dia 12 de julho, a cúpula com os líderes da zona euro ditou os seus termos de rendição ao primeiro-ministro grego, Alexis Tsipras, que, aterrorizado com as alternativas, aceitou todos eles. Um desses termos dizia respeito à disposição dos restantes ativos públicos da Grécia.

Os líderes da zona euro exigiram que os ativos públicos gregos sejam transferidos para um fundo do género Treuhand – um veículo de venda urgente semelhante ao utilizado após a queda do Muro de Berlim para privatizar rapidamente, com grande prejuízo financeiro e com efeitos devastadores no emprego de toda a propriedade pública do Estado alemão oriental que desvaneceu.

Este Treuhand grego seria sediado em – esperem por isso – Luxemburgo e seria gerido por uma equipe orientada pelo ministro das Finanças da Alemanha, Wolfgang Schäuble, o autor do esquema. Isso iria concluir as vendas urgentes no espaço de três anos. Mas atendendo a que o trabalho do Treuhand original foi acompanhado por investimentos maciços em infraestruturas por parte da Alemanha Ocidental e por transferências sociais em larga escala para a população da Alemanha Oriental, o povo da Grécia não receberia nenhum benefício correspondente de qualquer espécie.

Euclid Tsakalotos, que me sucedeu como ministro das Finanças da Grécia, há duas semanas, fez o seu melhor para melhorar os piores aspetos do plano grego Treuhand. Ele fez que o fundo ficasse domiciliado em Atenas e arrancou dos credores da Grécia (a chamada troika da Comissão Europeia, do Banco Central Europeu e do Fundo Monetário Internacional) a importante autorização para que as vendas possam continuar ao longo de 30 anos, em vez dos meros três. Isto foi crucial, pois irá permitir ao Estado grego manter os ativos subvalorizados até que o seu preço recupere dos baixos atuais induzidos pela recessão.

Infelizmente, o Treuhand grego continua a ser uma abominação e deveria ser um estigma na consciência da Europa. Pior, é uma oportunidade perdida.

O plano é politicamente tóxico, porque o fundo, embora domiciliado na Grécia, irá efetivamente ser gerido pela troika. É também financeiramente nocivo, porque as receitas irão pagar os juros daquela que até o FMI admite agora ser uma dívida impagável. E falha em nível econômico, porque desperdiça uma oportunidade maravilhosa de criar investimentos de produção nacional para ajudar a combater o impacto recessivo da consolidação fiscal punitiva que também faz parte dos “termos” da cimeira de 12 de julho.

As coisas não têm de ser assim. No dia 19 de junho, comuniquei ao governo alemão e à troika uma proposta alternativa, como parte de um documento intitulado “Acabar com a crise grega”:

“O governo grego propõe agrupar bens públicos (excluindo os pertinentes para a segurança do país, os equipamentos públicos e o património cultural) numa holding central separada da administração do governo e gerida como uma entidade privada, sob a égide do Parlamento grego, com o objetivo de maximizar o valor dos seus ativos subjacentes e criar um fluxo de investimento de produção nacional. O Estado grego será o único acionista, mas não irá garantir os seus passivos ou a sua dívida.”

A holding iria desempenhar um papel dinâmico, preparando os ativos para venda. Iria “emitir uma obrigação plenamente adicional nos mercados de capitais internacionais” para originar 30 a 40 mil milhões de euros (US$ 32 a US$ 43 bilhões), que, “tendo em conta o valor presente dos ativos”, iriam “ser investidos na modernização e reestruturação dos ativos sob a sua administração”.

O plano previa um programa de investimentos de 3-4 anos, resultando numa “despesa adicional de 5% do PIB por ano”, com condições macroeconómicas atuais implicando “um multiplicador de crescimento positivo acima de 1,5″, o que “deveria impulsionar o crescimento nominal do PIB para um nível superior a 5% durante vários anos”. Este, por sua vez, induziria “aumentos proporcionais em receitas fiscais”, dessa forma “contribuindo para a sustentabilidade fiscal, permitindo ao governo grego exercitar uma disciplina nos gastos sem diminuir ainda mais a economia social”.

Neste cenário, o superavit primário (que exclui o pagamento de juros) iria “alcançar magnitudes a uma “velocidade de escape” em absoluto, bem como termos percentuais ao longo do tempo”. Como resultado, à holding iria “ser concedida uma licença bancária” no prazo de um ou dois anos “transformando-se assim num banco de desenvolvimento de pleno direito com capacidade de complementaridade no investimento privado na Grécia e de entrar em projetos de colaboração com o Banco de Investimento Europeu”.

O banco de desenvolvimento que propusemos iria “permitir ao governo escolher que bens seriam, ou não, privatizados, garantindo ao mesmo tempo um maior impacto na redução da dívida a partir das privatizações selecionadas”. Afinal de contas, “os valores dos ativos deveriam aumentar mais do que o montante real gasto na modernização e na reestruturação, auxiliado por um programa de parcerias público-privadas, cujo valor é reforçado de acordo com a probabilidade de futura privatização”.

A nossa proposta foi saudada com um silêncio ensurdecedor. Mais precisamente, o Eurogrupo dos ministros das Finanças da zona euro e a troika continuaram a deixar passar para os meios de comunicação mundiais que as autoridades gregas não tinham propostas inovadoras, credíveis para oferecer – o seu refrão padrão. Alguns dias mais tarde, uma vez que as potências ter-se-ão apercebido de que o governo grego estaria prestes a render-se plenamente às exigências da troika, acharam conveniente impor à Grécia o seu degradante, sem imaginação e pernicioso modelo Treuhand.

Num ponto de virada na história da Europa, a nossa alternativa inovadora foi atirada para o caixote do lixo. Ela permanece lá para outros recuperarem.

Yanis Varoufakis é economista, blogueiro e político grego, membro do partido Syriza. Foi ministro das Finanças do Governo Tsipras.

http://correiodobrasil.com.br/europa-te ... =b20150723

Por uma Politica Solidária a Migração, abaixo os muros da intolerância

Re: Crise Grega

é verdade ativo, também não podemos ser mais papistas que o papa

- Mensagens: 69

- Registado: 18/2/2015 13:14

Re: Crise Grega

Jtx Escreveu:ativo Escreveu:Com os gregos (caloteiros) o "pagamento" deveria ser por medida aprovada: mais medidas aprovadas, mais dinheirinho. Nunca fiando ...

Discordo, deveria ser sim por medida aplicada, e resultados visíveis!

Pe, se a restauração não passar muitas facturas, e os gajos ajam como mafiosos, o iva a 23% facilmente não têm impacto nas receitas do estado..

Há medidas, que aprovadas, entram imediatamente em vigor, e outras, cuja aplicação é, naturalmente, mais demorada.

Quem está ligado: