Re: Broadcom (NASDAQ: AVGO)

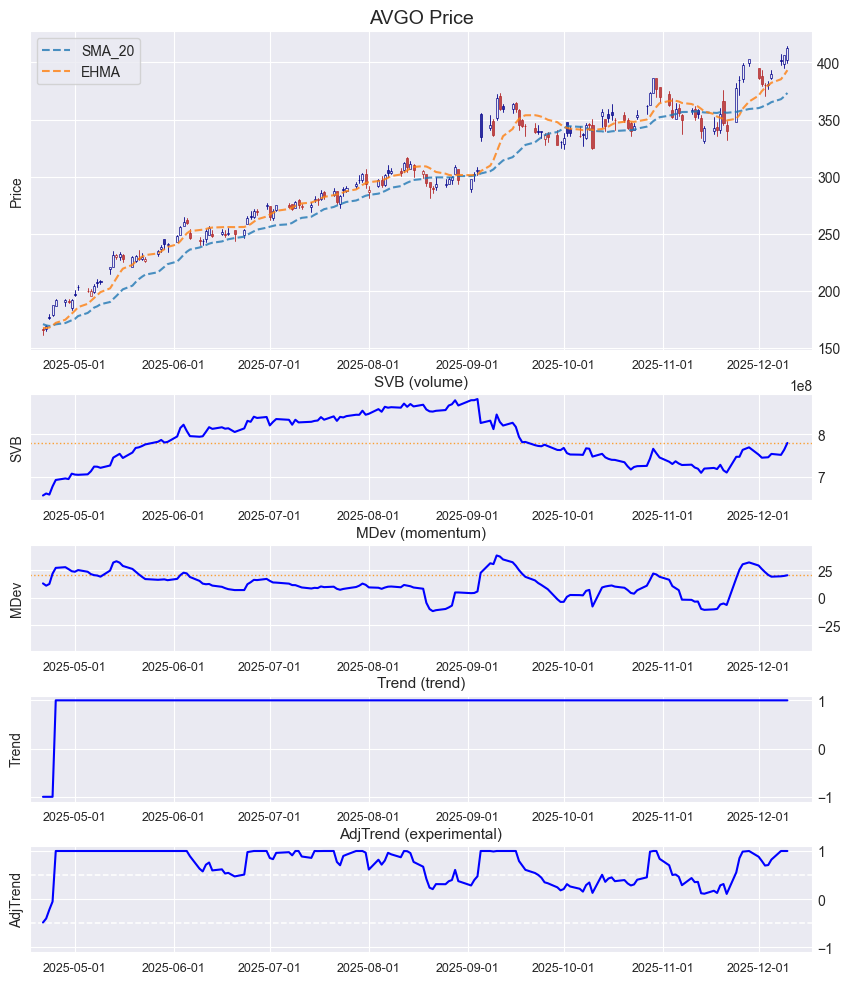

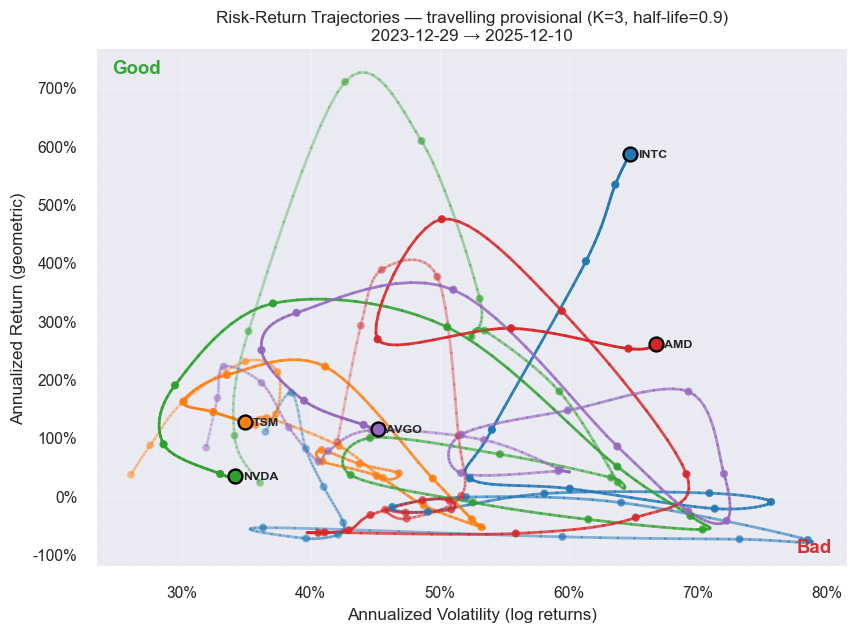

Broadcom (e TSMC também) a estabelecerem novos máximos históricos:

Fórum dedicado à discussão sobre os Mercados Financeiros - Bolsas de Valores

http://teste.caldeiraodebolsa.jornaldenegocios.pt/

http://teste.caldeiraodebolsa.jornaldenegocios.pt/viewtopic.php?f=3&t=97320

Nightrader Escreveu:E os Sete Magníficos passaram a oito.

Broadcom é o oitavo magnífico.

OpenAI set to start mass production of its own AI chips with Broadcom

ChatGPT maker’s deal with US chip group signals industry shift towards custom alternatives to Nvidia

OpenAI is set to produce its own artificial intelligence chip for the first time next year, as the ChatGPT maker attempts to address insatiable demand for computing power and reduce its reliance on chip giant Nvidia.

The chip, co-designed with US semiconductor giant Broadcom, would ship next year, according to multiple people familiar with the partnership.

Broadcom’s chief executive Hock Tan on Thursday referred to a mystery new customer committing to $10bn in orders.

OpenAI’s move follows the strategy of tech giants such as Google, Amazon and Meta, which have designed their own specialised chips to run AI workloads. The industry has seen huge demand for the computing power to train and run AI models.

OpenAI planned to put the chip to use internally, according to one person close to the project, rather than make them available to external customers.

(...)

Broadcom does not disclose the names of these customers, but people familiar with the matter confirmed OpenAI was the new client. Broadcom and OpenAI declined to comment.

(...)

The company was one of the earliest customers for Nvidia’s AI chips and has since proven to be a voracious consumer of its hardware.

Last month, Altman said the company was prioritising compute “in light of the increased demand from [OpenAI’s latest model] GPT-5” and planned to double its compute fleet “over the next 5 months”.

Broadcom Delivers Beat-And-Raise Report On AI Strength

Broadcom (AVGO) late Thursday beat analyst estimates for its fiscal third quarter and guided above views for sales in the current period. Broadcom stock rose on the news.

The fabless chipmaker and infrastructure software provider earned an adjusted $1.69 a share on sales of $15.95 billion in the quarter ended Aug. 3. Analysts polled by FactSet had expected Broadcom to earn $1.66 a share on sales of $15.83 billion. On a year-over-year basis, Broadcom earnings rose 36% while sales increased 22%.

(...)