US - A Mãe de todas as dívidas

Re: US - A Mãe de todas as dívidas

Um caso inédito nos últimos tempos. Pode dizer-se que o "efeito Mandela" chegou ao Congresso.

Mais do que concluir que se entra numa nova era, em que os políticos decidiram colocar os interesses da nação à frente da vontade dos grupos de pressão, este acordo mostra apenas que os partidos não ficaram satisfeitos com o resultado do último shutdown.

Mais do que concluir que se entra numa nova era, em que os políticos decidiram colocar os interesses da nação à frente da vontade dos grupos de pressão, este acordo mostra apenas que os partidos não ficaram satisfeitos com o resultado do último shutdown.

House passes bipartisan budget deal

POLITICO: By JAKE SHERMAN | 12/12/13 2:46 PM EST Updated: 12/13/13 6:07 AM EST

After a tumultuous and politically divisive year, the House ended 2013 on a rare bipartisan note by passing a budget deal supported by a nearly equal number of Republicans and Democrats.

The chamber voted 332-94 to approve the two-year budget deal crafted by Rep. Paul Ryan (R-Wis.) and Sen. Patty Murray (D-Wash.). The legislation won the support of 169 Republicans and 163 Democrats. It now heads to the Senate, where it will likely pass next week. President Barack Obama signaled he would sign the bill into law.

(...)

Both parties believe that the budget helps them politically. With the threat of a government shutdown mostly removed, Republicans think they can keep focus on the Affordable Care Act, which has had a troubled roll out. Democrats are already laying the groundwork to use January to pressure Republicans to extend emergency jobless benefits, which expire near the end of December.

(...)

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

POLITICO Breaking News

10/15/2013 17:03 GMT-4 (expires: 10/15/2013 18:03 GMT-4)

Fitch Ratings has put United States debt on "rating watch negative" because of the government's inability to raise the debt ceiling in a “timely manner” before the Oct. 17 deadline set by the Treasury Department. The announcement is not a downgrade but puts the U.S. on notice of a possible downgrade.

"Although Fitch continues to believe that the debt ceiling will be raised soon, the political brinkmanship and reduced financing flexibility could increase the risk of a U.S. default," Fitch said.

Fitch said prolonged negotiations over raising the debt ceiling "risks undermining confidence in the role of the U.S. dollar as the preeminent global reserve currency, by casting doubt over the full faith and credit of the U.S."

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

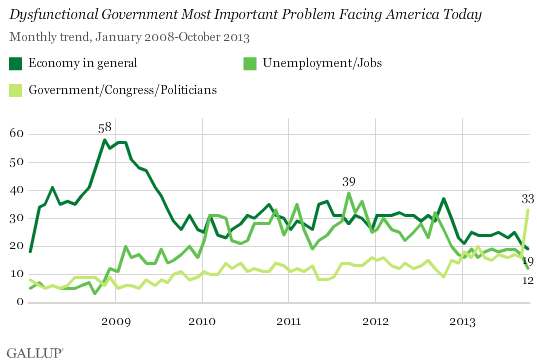

Dysfunctional Gov't Surpasses Economy as Top U.S. Problem

Highest percentage citing dysfunctional government in Gallup history

October 9, 2013, by Frank Newport - Gallup

RINCETON, NJ -- Americans are now more likely to name dysfunctional government as the most important problem facing the country than to name any other specific problem. Thirty-three percent of Americans cite dissatisfaction with government and elected representatives as the nation's top issue, the highest such percentage in Gallup's trend dating back to 1939. Dysfunctional government now eclipses the economy (19%), unemployment (12%), the deficit (12%), and healthcare (12%) as the nation's top problem.

Americans' mentions of either the economy in general or jobs in particular as the nation's top problem had already been declining in 2013. Both issues dropped further as top-of-mind concerns in the Oct. 3-6 survey, conducted in the midst of the U.S. government shutdown.

At the same time, the percentage of Americans who mention some aspect of government leadership as the nation's top problem has doubled, 33% this month from 16% last month.

This almost certainly reflects the current upheaval in Washington and party leaders' inability to agree on a way to fund the government or avoid a possible government default. October is the first time since 2008 when an economic issue was not at the top of Americans' list of most important problems.

Democrats (36%) and independents (33%) are somewhat more likely than Republicans (23%) to mention dysfunctional government as the most important problem facing the country, perhaps reflecting partisans' differing views about the role and importance of government.

Syria, which captured 8% of mentions last month, has faded in importance in Americans' minds, dropping back down to 1%. The percentage of Americans mentioning the federal budget and deficit as the top problem has increased from 5% in September to 12% now.

(...)

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

Isso é tão terrivel !! As yelds a 3 anos sobem para ... 0.66%!!

Treasury Bills Rates Rise Before First Post-Shutdown Coupon Sale

By Susanne Walker - Oct 8, 2013 3:08 PM GMT, Boomberg

Treasury bill rates climbed and yields on three-year notes rose for a third day as the U.S. prepares to sell $30 billion of the debt in the first auction of coupon securities since the government shutdown.

China and Japan, America’s largest foreign creditors with combined holdings of more than $2.4 trillion, raised pressure on the U.S. to resolve the impasse that has reached a week. Rates on Treasury bills due on Oct. 24 climbed to the highest since they were issued in April, after being negative as recently as Sept. 27. Benchmark 10-year notes fell before the government sells $21 billion of the securities tomorrow and $13 billion of 30-year bonds on Oct. 10.

“This uncertainty in Washington is causing troubles in the market, mostly in the front end, on whether issues maturing around that time will be paid off,” said Ray Remy, head of fixed income in New York at Daiwa Capital Markets America Inc., one of 21 primary dealers obligated to bid at Treasury auctions. “The three-year sector has gotten cheaper as the week has gone on.”

The U.S. three-year yield rose two basis points, or 0.02 percentage point, to 0.66 percent at 10:05 a.m. New York time, according to Bloomberg Bond Trader prices. The price of the 0.875 percent note maturing in September 2016 fell 2/32, or 63 cents per $1,000 face value, to 100 20/32. The 10-year yield rose one basis point to 2.64 percent.

‘Russian Roulette’

The difference in rates between one- and three-month bills reached 18.2 basis points, the biggest since March 2008, according to closing-market data. Three-month bill rates climbed as high as 0.1014 percent after touching negative 0.0101 percent on Sept. 27, the lowest level this year. The 2013 average is 0.047 percent. Rates on one-month bills reached 0.23 percent.

“If we do not lift the debt ceiling and if we default, the world goes into recession,” Mohamed El-Erian, chief executive and co-chief investment officer at Pacific Investment Management Co., the world’s biggest bond-fund manager, said in a television interview on “Bloomberg Surveillance” with Tom Keene. “This is not about an ability to pay, this is about a willingness to pay. We are playing Russian roulette.”

Nonessential U.S. government services have been closed for a week as politicians wrangle over a budget. Republicans want to change the 2010 Affordable Care Act, while President Barack Obama refuses to discuss conditions tied to opening the government or raising the debt limit. Treasury Secretary Jacob J. Lew said Congress needs to increase the debt ceiling by Oct. 17 or the nation risks defaulting on its payments.

Past Crises

Two years ago, as the Aug. 2, 2011, deadline set by the Treasury to avoid a default approached, one-month bill rates climbed to a 29-month high of 0.18 percent. They yielded 0.015 percent in December 2012 before a year-end trigger for automatic spending cuts and tax increases. The three-month rate climbed to 0.11 percent before the August 2011 deadline, and rose as high as 0.08 percent in the week before Dec. 31, 2012.

The International Monetary Fund warned that a U.S. government default could “seriously damage” the world economy.

“A failure to promptly raise the debt ceiling could also adversely affect financial markets and economic activity, with spillovers to the rest of the world,” the IMF said in a report released today in Washington.

China, Japan

The U.S. should ensure the security of China’s investment, Deputy Finance Minister Zhu Guangyao said yesterday, the People’s Daily newspaper reported on its website. China owned $1.28 trillion of U.S. government debt as of July, according to the Treasury Department.

Japan is the second-largest overseas holder with a $1.14 trillion stake. Investors from the Asian nation purchased a net 951.9 billion yen ($9.8 billion) of the securities in August, Ministry of Finance data showed today.

“Japan must be aware that the absolute value of those debt holdings would decline,” Finance Minister Taro Aso said at a news conference in Tokyo. The nation must consider the impact of a default on its Treasury holdings, even as the U.S. will probably avoid a fiscal crisis, he said.

Aside from the securities maturing closest to the debt-ceiling deadline, longer-term Treasuries are in demand as a haven amid the threat the government’s partial shutdown will slow economic growth.

Investors in Treasuries were more bullish for the fourth straight week ending yesterday, betting that the prices of the securities will rise, according to a survey by JPMorgan Chase & Co. (...)

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

O actual impasse do shut down é "música para adormecer meninos" comparado com o "rock da pesada" que teríamos se esta tentativa extorsão ao Governo se prolongasse para lá do limite do tecto da dívida (acontecerá pelo dia 17 de Outubro)

Aí sim, a América arrisca-se a deixar de poder pagar as suas dívidas. Estaríamos na fronteira uma situação apenas comparável com a dos "mísseis de Cuba" do tempo do Kennedy-Kruschev.

Até aqui estão a passar-se mensagens de apelo à calma de ambos os lados, e supõe-se que não há gente suficientemente tarada naqueles partidos para atirar voluntariamente com o país, e basicamente o mundo inteiro, pelo esgoto de um colapso económico. Até porque não há precedentes.

Para mim a melhor bola de cristal continuam a ser os mercados, e não as declarações dos políticos. E para já continuam a portar-se com relativa tranquilidade, nomeadamente os juros da dívida, que abanam mas aguentam-se.

Mas quando se pensa que o destino está nas mãos de um punhado de radicais dogmáticos e ultra conservadores, que se acreditam inspirados e já paralisaram o Governo, a pergunta é: "até aonde é que a paranóia poderá chegar".

Seguramente não é ainda altura de qualquer pânico, mas sim de muita prudência nos investimentos.

Aí sim, a América arrisca-se a deixar de poder pagar as suas dívidas. Estaríamos na fronteira uma situação apenas comparável com a dos "mísseis de Cuba" do tempo do Kennedy-Kruschev.

Até aqui estão a passar-se mensagens de apelo à calma de ambos os lados, e supõe-se que não há gente suficientemente tarada naqueles partidos para atirar voluntariamente com o país, e basicamente o mundo inteiro, pelo esgoto de um colapso económico. Até porque não há precedentes.

Para mim a melhor bola de cristal continuam a ser os mercados, e não as declarações dos políticos. E para já continuam a portar-se com relativa tranquilidade, nomeadamente os juros da dívida, que abanam mas aguentam-se.

Mas quando se pensa que o destino está nas mãos de um punhado de radicais dogmáticos e ultra conservadores, que se acreditam inspirados e já paralisaram o Governo, a pergunta é: "até aonde é que a paranóia poderá chegar".

Seguramente não é ainda altura de qualquer pânico, mas sim de muita prudência nos investimentos.

Treasuries Advance as Lew’s Default Warning Boosts Safety Demand

By Susanne Walker & David Goodman - Oct 7, 2013 3:15 PM GMT, Blommberg

U.S. government securities rose, snapping a decline from last week, after Treasury Secretary Jacob J. Lew said Congress needs to increase the debt ceiling by Oct. 17 or the nation risks defaulting on its payments.

Stocks declined as investors sought the safety of Treasuries after U.S. Speaker John Boehner said the country may end up in default if President Barack Obama doesn’t negotiate over the budget. The government stopped providing nonessential services last week after lawmakers failed to agree on a spending package, boosting speculation the Federal Reserve will refrain from reducing its stimulus program this year. The U.S. will sell $64 billion of notes and bonds this week.

“There’s a low probability of default, but there’s a high probability they will take it down to the wire,” said Thomas Roth, senior Treasury trader in New York at Mitsubishi UFJ Securities USA Inc. “The fear outweighs anything else. We’re more likely to go higher in prices.”

The benchmark 10-year yield fell two basis points, or 0.02 percentage point, to 2.62 percent at 10:13 a.m. in New York, according to Bloomberg Bond Trader prices. The 2.5 percent note maturing in August 2023 rose 6/32, or $1.88 per $1,000 face amount, to 98 30/32.

Yields increased two basis points last week. While they have climbed from a record low of 1.379 percent in July 2012, they are below the average of about 6.4 percent since September 1981, the start of the three-decade bull market in bonds.

The Standard & Poor’s 500 Index of stocks declined 0.5 percent.

http://www.bloomberg.com/news/2013-10-0 ... rning.html (...)

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

And here they go again...

Para quem já não se lembra, da última vez que estes dois animais (o elefante e o burro) se enfrentaram no Congresso por causa do debt ceiling, a dívida dos US é que apanhou o olho negro.

No caso, o perdeeu o rating AAA da Standard & Poor's.

Os mercados mostram um estranho suspense...

Como quem espera pelo final de uma cena de Hollywood, em que o herói duvida se há-se corta o fio vermelho ou azul de uma ogiva nuclear.

Como se sabe, isto corresponde a probabilidades iguais de rebentar ou ficar com a diva suculenta, mas que, e sabe-se lá como, acaba sempre aos beijinhos.

A América só surpreende os americanos...

Para quem já não se lembra, da última vez que estes dois animais (o elefante e o burro) se enfrentaram no Congresso por causa do debt ceiling, a dívida dos US é que apanhou o olho negro.

No caso, o perdeeu o rating AAA da Standard & Poor's.

Os mercados mostram um estranho suspense...

Como quem espera pelo final de uma cena de Hollywood, em que o herói duvida se há-se corta o fio vermelho ou azul de uma ogiva nuclear.

Como se sabe, isto corresponde a probabilidades iguais de rebentar ou ficar com a diva suculenta, mas que, e sabe-se lá como, acaba sempre aos beijinhos.

A América só surpreende os americanos...

The debt ceiling

Two can play at that suicidal game!

Sep 26th 2013, 19:02 by M.S.

(...)

If either party can take advantage of this sort of doomsday threat, it should be clear that neither can. To underline that fact, Mr Obama ought to counter the Republican threat not to raise the debt ceiling, with a threat of his own to veto a raise in the debt ceiling. Republicans may demand the postponement of Obamacare in exchange for a debt-ceiling hike. Mr Obama can demand passage of an immigration-reform bill including a path to citizenship in exchange for a debt-ceiling hike. Will Democrats risk defaulting on America's debt in order to preserve Obamacare? Will Republicans risk defaulting on America's debt in order to block immigration reform? Heck, why not throw in the rest of both parties' agendas: approving Keystone XL, ending the sequester, banning abortion, fully funding Head Start, slashing food stamps, fully funding food stamps, firing Big Bird, taking away everybody's guns? All of this must happen before October 31st, or the House will refuse to pass a debt-ceiling hike, and the president will also veto it!

Obviously, this idea is ridiculous. For one thing, there's no concrete difference between Mr Obama threatening to veto a debt-ceiling hike and simply refusing to negotiate over it, which is what he's doing now. For another thing, yield curves are already starting to invert just at the prospect of Republican resistance to a debt-ceiling hike; if Mr Obama signaled his willingness to veto one too, all hell could break loose. I mean, the whole idea that Mr Obama would threaten to tank America's credit rating and the global economy in order to achieve his legislative agenda is just nuts. Whereas Republicans, well, you just have to expect them to pull that sort of stunt, because...because why again?

http://www.economist.com/blogs/democrac ... bt-ceiling

"In God we trust. Everyone else, bring data" - M Bloomberg

Re: US - A Mãe de todas as dívidas

Moody's melhora perspectiva dos EUA e reitera rating de topo

18 Julho 2013, 21:24 por Carla Pedro | cpedro@negocios.pt, Diogo Cavaleiro | diogocavaleiro@negocios.pt

A agência de notação financeira elevou o "outlook" dos Estados Unidos, de 'negativo' para 'estável'. E manteve a classificação da dívida soberana de longo prazo em 'Aaa'.

A Moody's melhorou a perspectiva para a dívida soberana dos EUA. E considera que a qualidade do crédito norte-americano é de topo, tendo por isso mantido a notação máxima: 'Aaa'.

A perspectiva negativa pendia sobre a dívida norte-americana desde Agosto de 2011, altura em que o país se encontrava num impasse devido às negociações entre os partidos para o aumento do tecto de endividamento. Agora, a justificação para a evolução da perspectiva está na trajectória da dívida e dos défices dos Estados Unidos.

“Os défices orçamentais dos EUA têm vindo a cair e espera-se que continuem a descer nos próximos anos”, assinala a agência de notação financeira num comunicado distribuído esta quinta-feira, 18 de Julho. “Além disso, o crescimento da economia norte-americana, embora moderado, está a ocorrer a uma taxa mais acelerada quando comparada com a de outros pares avaliados com ‘rating’ ‘Aaa’”, acrescenta a Moody’s no mesmo documento.

“Com a redução do défice orçamental e o antecipado crescimento no produto interno bruto nominal, o CBO [gabinete de estatísticas orçamentais] prevê que o rácio de dívida face ao PIB atinja o máximo de 76% em 2014 e venha depois a cair em cinco pontos percentuais até 2018”, escreve a Moody’s para argumentar a mudança da perspectiva para “estável” em vez de “negativo”.

A Moody's e a Fitch são as duas agências que atribuem o "rating" máximo aos Estados Unidos, sendo que a S&P retirou o conhecido triplo A precisamente em Agosto de 2011.

"In God we trust. Everyone else, bring data" - M Bloomberg

Epá ontem na entrevista ao Louçã mostrou lá um gráfico da dívida portuguesa muito interessante! A divida subia até 2016 e depois entrava numa correcção e consolidava até 2019, e daí para a frente era sempre a subir.

Creio que será o mesmo rumo que vão dar aos mercados.

Não tem sentido os mercados entrarem em colapso por causa duma divida elevada.

Creio que será o mesmo rumo que vão dar aos mercados.

Não tem sentido os mercados entrarem em colapso por causa duma divida elevada.

QuimPorta Escreveu:O Paul Krugman (nobel de economia 2008) tem andado numa campanha "spend now, cut later", o que é motivo de escândalo entre os republicanos, e realmemte soa a estranho quando a dívida americana corre o risco de se descontrolar devido aos encargos sociais ("entitlements"), do Estado, sobretudo com a Saúde.

Joe Scarborough (Republicano moderado que tem um show diário na NBCNEWS, e ex-congressista) consegui manter uma discussão civilizada quase durante 60 minutos.

Um excelente concentrado de discussão sobre o Keynesianismo aplicado à realidade da economia dos US, quando ainda há (pelo menos há quem ache) margem para se gastar mais uns anos.

<iframe width="420" height="315" src="http://www.youtube.com/embed/Ei0r6MBeV7Q" frameborder="0" allowfullscreen></iframe>

Quote of the Day: Joe Scarborough vs. Joe Scarborough

Compare and contrast. Here is Joe Scarborough during his debate with Paul Krugman on Monday:

Q: Would you support an extra $200 billion a year in spending on infrastructure and education right now?

A: Oh yeah. I talk about it all the time. I go around and I talk to Republicans all the time.

And here is Scarborough writing with Jeffrey Sachs in the Washington Post today:

Both of us opposed the [2009] stimulus package, the increased spending in Afghanistan and Washington’s fixation on short-term thinking. We said that the only result of this short-termism would be exploding deficits. And well before Obama himself acknowledged the point, we said that there was no such thing as “shovel-ready” projects worthy of public investment in the 21st century.

I'm confused. During the worst of the financial crash, with GDP plummeting like a rock, Scarborough opposed stimulus spending and believed that there were no infrastructure investments worth pursuing. But today, with the economy fragile but recovering, he thinks it would be great to spend $200 billion more on infrastructure and education.

Something ain't right here. And I have to say, for a guy who talks about this extra spending "all the time," he sure missed a chance to do it again in today's op-ed. I wonder what Joe really thinks?

in http://www.motherjones.com/kevin-drum/2 ... carborough

- Mensagens: 848

- Registado: 4/1/2004 22:32

- Localização: lx

Mais uma vítima do "sequester"

With canceled tours, White House teaching how democracy works

http://www.washingtonpost.com/politics/ ... ml?hpid=z1

With canceled tours, White House teaching how democracy works

http://www.washingtonpost.com/politics/ ... ml?hpid=z1

- Mensagens: 848

- Registado: 4/1/2004 22:32

- Localização: lx

Uma notícia, muito mas muito oportuna mesmo.

Melhor mesmo será se houver um acordo sobre o controlo da dívida, pelo menos de médio prazo Congresso.

Seria quanto a mim o passo definitivo para começarmos a ver o episódio da "Grande Recessão" pelo retrovisor.

Melhor mesmo será se houver um acordo sobre o controlo da dívida, pelo menos de médio prazo Congresso.

Seria quanto a mim o passo definitivo para começarmos a ver o episódio da "Grande Recessão" pelo retrovisor.

February jobs report: Stronger than expected

MONEYWATCH/ March 8, 2013, 8:59 AM

The Labor Department said 236,000 jobs were created in February and the unemployment rate edged lower to 7.7 percent from 7.9 percent. This level of job growth is welcome, but many are taking a wait and see approach to the job situation until the effects of sequestration are fully known.

The February employment report is the last one before the government's across the board spending cuts go into effect. Economists are waiting to see whether the Congressional Budget Office's projection of 750,000 fewer jobs comes to fruition or whether the U.S. economy is strong enough to weather the cuts and continue to create enough private sector jobs to compensate for the government jobs that could vanish.

Capital Economics framed the bullish case on the economy, noting, "Despite the continued drag from fiscal austerity, the outlook for the economy is improving." The improvement can be seen in a few ways: Business investment is accelerating, due to robust earnings growth; housing will no longer be a headwind for the economy and instead will contribute to growth; manufacturing has started to pick up after a break; and consumers appear to be absorbing the expiration of the payroll tax cut, without too large a hit to confidence or spending. Taken together, the analysis projects a slowdown in growth to about 1 percent for the first half of the year, followed by a second-half annualized rate of 2.5 percent

(...)

"In God we trust. Everyone else, bring data" - M Bloomberg

O Paul Krugman (nobel de economia 2008) tem andado numa campanha "spend now, cut later", o que é motivo de escândalo entre os republicanos, e realmemte soa a estranho quando a dívida americana corre o risco de se descontrolar devido aos encargos sociais ("entitlements"), do Estado, sobretudo com a Saúde.

Joe Scarborough (Republicano moderado que tem um show diário na NBCNEWS, e ex-congressista) consegui manter uma discussão civilizada quase durante 60 minutos.

Um excelente concentrado de discussão sobre o Keynesianismo aplicado à realidade da economia dos US, quando ainda há (pelo menos há quem ache) margem para se gastar mais uns anos.

<iframe width="420" height="315" src="http://www.youtube.com/embed/Ei0r6MBeV7Q" frameborder="0" allowfullscreen></iframe>

Joe Scarborough (Republicano moderado que tem um show diário na NBCNEWS, e ex-congressista) consegui manter uma discussão civilizada quase durante 60 minutos.

Um excelente concentrado de discussão sobre o Keynesianismo aplicado à realidade da economia dos US, quando ainda há (pelo menos há quem ache) margem para se gastar mais uns anos.

<iframe width="420" height="315" src="http://www.youtube.com/embed/Ei0r6MBeV7Q" frameborder="0" allowfullscreen></iframe>

"In God we trust. Everyone else, bring data" - M Bloomberg

Parece-me garantido que pelo menos os cortes na dafesa vão ser atenuados porque os Republicanos não irão seguramente votar contra iniciativas legislativas nessa área.

Quanto ao resto há que esperar.

Há muita discussão sobre o que se segue, e as fontes divergem demasiado em função da afinidade política.

É dificil perceber ao certo o representarão estes $85B num ano fiscal. Dá para ver que corresponde grosso modo aos programa de assistência português e irlandês, metido num ano só ano fiscal.

À partida parecem-me "tremoços", para a maior economia do mundo mas a fonte que considero mais credível e isenta que é o Congressional Budget Office (CBO), não é para aí que aponta.

Quanto ao resto há que esperar.

Há muita discussão sobre o que se segue, e as fontes divergem demasiado em função da afinidade política.

É dificil perceber ao certo o representarão estes $85B num ano fiscal. Dá para ver que corresponde grosso modo aos programa de assistência português e irlandês, metido num ano só ano fiscal.

À partida parecem-me "tremoços", para a maior economia do mundo mas a fonte que considero mais credível e isenta que é o Congressional Budget Office (CBO), não é para aí que aponta.

Automatic Reductions in Government Spending -aka Sequestration

CBO, on february 28, 2013

We have received many questions in recent days about the budgetary and economic implications of the automatic reductions in government spending that are scheduled to occur under current law (in technical terms, a sequestration). So, we thought it would be helpful to pull together our answers to some of those questions, incorporating information from our most recent economic and budget projections released earlier this month and from CBO’s recent Congressional testimony:

How Will Budgetary Developments in 2013 Affect Economic Growth This Year?

In fiscal year 2013, by CBO’s estimates, federal revenues will rise and outlays will decline as shares of gross domestic product (GDP), resulting in a federal budget deficit equal to about 5.3 percent of GDP (compared with 7.0 percent last year). The fiscal policies that reduce the deficit will lead to less demand for goods and services, thereby holding down economic growth this year, as CBO reported in The Budget and Economic Outlook: Fiscal Years 2013 to 2023. If not for that fiscal tightening, CBO estimates, economic growth in 2013 would be roughly 1½ percentage points faster than the 1.4 percent real (inflation-adjusted) growth that the agency now projects, under current laws, from the fourth quarter of calendar year 2012 to the fourth quarter of 2013.

How Are Changes in Tax and Spending Policies Contributing to That Outcome?

The fiscal tightening in 2013 is mostly a result of two developments: the expiration of certain tax policies that will lead to an increase in tax revenue (relative to 2012, payroll tax rates are higher and tax rates on income above certain thresholds have increased); and the automatic spending reductions scheduled to occur under current law (the sequestration). In the absence of those policies, real GDP would grow about 1¼ percentage points faster between the fourth quarter of last year and the fourth quarter of this year, CBO estimates. (The remaining ¼ percentage point reduction in economic growth due to fiscal tightening comes from other, smaller changes in spending and taxes.) The expiration of those tax provisions and the automatic spending cuts account for about equal portions of that 1¼-percentage-point effect. The spending changes have a smaller budgetary impact than the tax changes, but they affect GDP by a larger amount per dollar of budgetary cost.

In the absence of sequestration, CBO estimates, GDP growth would be about 0.6 percentage points faster during this calendar year, and the equivalent of about 750,000 more full-time jobs would be created or retained by the fourth quarter. By CBO’s estimate, extending the tax provisions that expired would have similar positive effects on output and jobs. Those economic effects represent CBO’s central estimates, which are based on the assumption that the values for key aspects of economic behavior are the midpoints of CBO’s ranges for those values.

http://www.cbo.gov/publication/43961

(...)

"In God we trust. Everyone else, bring data" - M Bloomberg

QuimPorta Escreveu:Senate Republicans Kill Sequestration Alternative

TPM, FEBRUARY 28, 2013, 3:17 PM 13025

Senate Republicans have filibustered a Democratic bill that would pay down sequestration’s indiscriminate spending cuts for a year.

Though the vote outcome was never in doubt, the legislation’s demise assures that Congress will miss Friday’s sequestration deadline, and federal agencies will begin cutting projects and services.

The final vote was 51-49. It needed 60 votes to pass. Sens. Kay Hagan (D-NC), Mary Landrieu (D-LA), and Mark Pryor (D-AR) voted with a unified GOP conference to block the bill. All three face tough elections in 2014. Senate Majority Leader Harry Reid also switched his vote from yes to no — a procedural maneuver that preserves his right to call the measure up for a vote again quickly in the future.

If the bill would have become law, it would have replaced tens of billions of dollars in spending cuts set to take place this year with 10 years’ worth of deficit reducing tax increases and targeted spending cuts. The revenue would have come largely from individuals making over $5 million a year, by imposing a minimum “Buffett Rule” tax on their earnings. The cuts would have been divided evenly between agriculture subsidies and defense spending.

(...)

With both the House and Senate now out of session, and no legislation on the docket in either chamber to address sequestration, the Obama administration will be forced to issue the order on Friday. President Obama has invited congressional leaders to the White House tomorrow to discuss sequestration, but officials from both parties predict the event will yield little progress.

As the cuts roll out, House Republicans will ready legislation to renew funding for federal agencies, which expires altogether at the end of March, irrespective of sequestration. That legislation — known as a continuing resolution — could reach the House floor as early as next week. And depending upon how it’s constructed, it could determine how the fight over sequestration ultimately comes to an end.

vamos agora ver os impactos dos serviços que irão ser cortados....

acredito que os projectos na saúde e energias alternativas levem por tabela...

- Mensagens: 6450

- Registado: 7/4/2007 17:13

- Localização: Algarve

Senate Republicans Kill Sequestration Alternative

TPM, FEBRUARY 28, 2013, 3:17 PM 13025

Senate Republicans have filibustered a Democratic bill that would pay down sequestration’s indiscriminate spending cuts for a year.

Though the vote outcome was never in doubt, the legislation’s demise assures that Congress will miss Friday’s sequestration deadline, and federal agencies will begin cutting projects and services.

The final vote was 51-49. It needed 60 votes to pass. Sens. Kay Hagan (D-NC), Mary Landrieu (D-LA), and Mark Pryor (D-AR) voted with a unified GOP conference to block the bill. All three face tough elections in 2014. Senate Majority Leader Harry Reid also switched his vote from yes to no — a procedural maneuver that preserves his right to call the measure up for a vote again quickly in the future.

If the bill would have become law, it would have replaced tens of billions of dollars in spending cuts set to take place this year with 10 years’ worth of deficit reducing tax increases and targeted spending cuts. The revenue would have come largely from individuals making over $5 million a year, by imposing a minimum “Buffett Rule” tax on their earnings. The cuts would have been divided evenly between agriculture subsidies and defense spending.

(...)

With both the House and Senate now out of session, and no legislation on the docket in either chamber to address sequestration, the Obama administration will be forced to issue the order on Friday. President Obama has invited congressional leaders to the White House tomorrow to discuss sequestration, but officials from both parties predict the event will yield little progress.

As the cuts roll out, House Republicans will ready legislation to renew funding for federal agencies, which expires altogether at the end of March, irrespective of sequestration. That legislation — known as a continuing resolution — could reach the House floor as early as next week. And depending upon how it’s constructed, it could determine how the fight over sequestration ultimately comes to an end.

"In God we trust. Everyone else, bring data" - M Bloomberg

Valete Escreveu:De 2 em 2 meses vamos andar nisto?

2 meses? Já passámos essa fase.

A estratégia dos Republicanos tende para ser a das barracas dos carrinhos de choque: uma moedinha por cada voltinha.

A má notícia perece vir dos mercados que não estão a ligar uma pevide ao risco de a ruptura política imobilizar o governo e a economia.

É óbvio que toda a gente percebeu que os Republicanos sabem ladrar. Mas se não morderam até agora...

Will A Government Shutdown Threat Determine The Winner Of The Sequestration Fight?

FEBRUARY 28, 2013, 6:00 AM

If the consequences of indiscriminate defense and domestic spending cuts aren’t severe enough at the outset to force Congress and the White House to cut a deal in early March, the fight over sequestration could easily be swallowed by a different — more routine, but more pressing — budget fight.

Funding for the federal government expires on March 27, and if Congress doesn’t pass legislation to renew that funding, most government services will grind to a halt. The turbulence of sequestration will turn into the spiral-dive of a government shutdown.

These issues might seem wholly distinct. After all, sequestration emerged as a tool to force Congress into an agreement on taxes and entitlement spending, whereas a government shutdown would be the consequence of Congress failing to pass federal appropriations — a different category of spending altogether

"In God we trust. Everyone else, bring data" - M Bloomberg

Elias Escreveu:Marco Martins Escreveu:- Chegamos a um momento limite de austeridade, onde as pessoas estão claramente a mostrar que não gostam nem acreditam nos políticos (sejam da sua cor partidaria ou não!).

Como sabes que chegámos ao limite? Na verdade já ouço essa conversa há mais de um ano...

Se as pessoas estão a mostrar claramente que não gostam dos políticos, como explicas que o PS e o PSD continuem a ter 30% nas sondagens?

Acho que Itália é o exemplo mais claro desse descontentamento. O partido do "palhaço" anti-europa e anti-políticos em 3 meses, tornou-se um dos maiores partidos políticos.

Este tipo de mudança tão radical em tão pouco período de tempo é sério e pode levar a rupturas profundas na sociedade porque quem chega ao poder está com toda a força de liderança e não tem nada a perder com a mudança.

- Mensagens: 6450

- Registado: 7/4/2007 17:13

- Localização: Algarve

Valete Escreveu:De 2 em 2 meses vamos andar nisto?

Desta vez, esta acalmia é de desconfiar. Na história, do rapaz e do lobo, o lobo tarda, mas não falha.

As previsões do impacto do "sequester" no PIB não apontam para números tão significativos como outros acontecimentos passados.

Haverá impactos mais importantes a nível Estadual que propriamente a nível nacional, que não sendo desprezíveis, não são à partida decisivos.

"...is related to the automatic spending sequestration that is scheduled to begin on March 1, which according to the CBO’s estimates, will contribute about 0.6 percentage point to the fiscal drag on economic growth this year."

PS: É evidente o conceito Keynesiano por detrás de todas estas linhas de reciocínio, em que a diminuição dod Gastos do Estado implica um "decréscimo" do crescimento. Faço esta chamada de atenção para todos os liberais et al que abundam neste fórum

Editado pela última vez por Visitante em 28/2/2013 17:45, num total de 1 vez.

- Mensagens: 848

- Registado: 4/1/2004 22:32

- Localização: lx

Marco Martins Escreveu:- Chegamos a um momento limite de austeridade, onde as pessoas estão claramente a mostrar que não gostam nem acreditam nos políticos (sejam da sua cor partidaria ou não!).

Como sabes que chegámos ao limite? Na verdade já ouço essa conversa há mais de um ano...

Se as pessoas estão a mostrar claramente que não gostam dos políticos, como explicas que o PS e o PSD continuem a ter 30% nas sondagens?

- Mensagens: 35428

- Registado: 5/11/2002 12:21

- Localização: Barlavento

Valete Escreveu:De 2 em 2 meses vamos andar nisto?

Desta vez, esta acalmia é de desconfiar. Na história, do rapaz e do lobo, o lobo tarda, mas não falha.

Neste momento se sem um vento mais forte dos states, a europa constipasse mesmo!!!

- Itália está perto da ingovernabilidade e cada vez mais anti-alemanha

- Alemanha tem eleições este ano e estão a chamar os italianos de palhaços

- Os bancos e a economia Irlandesa, Espanhola e Portuguesa ainda estão aquém do que deveriam estar e muito sensíveis às variações dos mercados

- França já não consegue ser um motor na europa e está também com vários problemas

- Chegamos a um momento limite de austeridade, onde as pessoas estão claramente a mostrar que não gostam nem acreditam nos políticos (sejam da sua cor partidaria ou não!).

Um problema fiscal nos states, apenas não fará mais do que fazer esta bolha social da europa estourar.

(mas isto sou eu com uma visão negativista... se calhar se chegarem a acordo até posso achar que chegou o momento da mudança e que tudo está bem!!!)

- Mensagens: 6450

- Registado: 7/4/2007 17:13

- Localização: Algarve

CTR2004 Escreveu:Já falta pouco...

Vamos ver como as bolsas reagem amanhã...

Até agora parece que a não chegada de acordo não está a causar impato nenhum, ou possivelmente muita gente está à espera que saia a notícia...

Há um aforismo que diz: The market never dances twice with the same partner

- Mensagens: 35428

- Registado: 5/11/2002 12:21

- Localização: Barlavento

Faltam 2 dias para a entrada em vigor do "The Sequester" e nem com a Itália num impasse politico os mercados pestanejam.

Os americanos já conhecem os políticos que têm e confiam que um heroi qualquer vai aparecer no último segundo a cortar o fio certo da bomba de $85 B prestes a estoirar na economia americana.

É abastecer de pipocas que o filme está prestes a (re)começar...

Os americanos já conhecem os políticos que têm e confiam que um heroi qualquer vai aparecer no último segundo a cortar o fio certo da bomba de $85 B prestes a estoirar na economia americana.

É abastecer de pipocas que o filme está prestes a (re)começar...

Sequestration Cuts Draw Yawns From Americans As March 1 Looms

By JOSH LEDERMAN 02/27/13 03:07 AM ET EST

WASHINGTON -- President Barack Obama is pulling out all the stops to warn just what could happen if automatic budget cuts kick in. Americans are reacting with a collective yawn.

They know the shtick: Obama raises the alarm, Democrats and Republicans accuse each other of holding a deal hostage, there's a lot of yelling on cable news, and then finally, when everyone has made their points, a deal is struck and the day is saved.

Maybe not this time. Two days before $85 billion in cuts are set to hit federal programs with all the precision of a wrecking ball, there are no signs that the White House and Republicans in Congress are even negotiating. Both sides appear quietly resigned to the prospect that this is one bullet we just may not dodge. (...)

http://www.huffingtonpost.com/2013/02/2 ... f=politics

- Anexos

-

- sequester.png (71.76 KiB) Visualizado 4817 vezes

"In God we trust. Everyone else, bring data" - M Bloomberg

O discurso do Estado da Nação da semana passada teve a dívida como tema principal.

Teve uma audiência de 30 milhões de espectadores.

Deixo aqui a versão "ilustrada pela Casa Branca

<iframe width="560" height="315" src="http://www.youtube.com/embed/S7doAXkmGJw" frameborder="0" allowfullscreen></iframe>

Teve uma audiência de 30 milhões de espectadores.

Deixo aqui a versão "ilustrada pela Casa Branca

<iframe width="560" height="315" src="http://www.youtube.com/embed/S7doAXkmGJw" frameborder="0" allowfullscreen></iframe>

"In God we trust. Everyone else, bring data" - M Bloomberg

Quem está ligado:

Utilizadores a ver este Fórum: Google [Bot], Phil2014 e 58 visitantes